Last Week’s Markets in Review: U.S. Stocks Extend Winning Streak

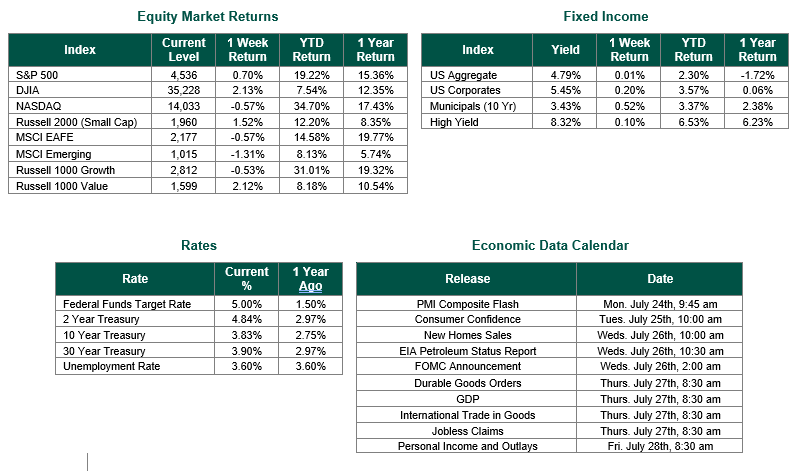

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,536, representing an increase of 0.70%, while the Russell Midcap Index moved 1.23% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.52% over the week. As developed international equity performance and emerging markets were lower, returning -0.57% and -1.31%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the week at 3.83%.

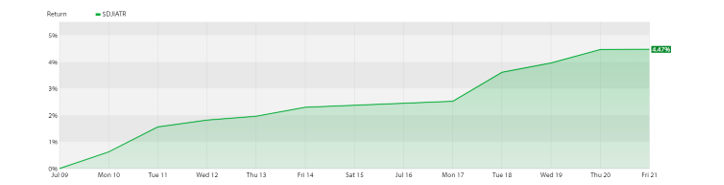

U.S. stocks, specifically those within the Dow Jones Industrial Average (DJIA), extended their winning streak to 10 days on Friday last week. This streak is a record that would still fall well short of Joe DiMaggio’s record-hitting streak, but one that had not been achieved since 2017. The index was driven last week by strong corporate earnings reports from constituents Johnson and Johnson and Goldman Sachs. According to FactSet, 75% of companies that reported earnings as of 7/21/23 exceeded analyst expectations. Over the 10-day streak period, the DJIA rose by 4.47%.

Despite earnings season being in full swing and dominating much of what equity markets have focused on, the housing market delivered results on both starts and existing home sales last week. Housing starts for June have fallen by 8% to an annual rate of 1.43 million units, below the Refinitiv forecast of 1.48 million. The housing start figures confirmed the continued challenges in today’s real estate market, buoyed by very low supply and high demand. These challenges were further emphasized later in the week when existing home sales in June fell to their slowest pace in 14 years as higher interest rates seem to be preventing existing owners from parting with properties and first-time home buyers are struggling with affordability.

The Federal Reserve’s July meeting is on tap for this week, and we will be sure to break down what they announce in next week’s update. We hope that everyone has a productive week ahead!

DJIA Chart obtained from Kwanti Analytics on 7/21/23. Corporate earnings data is sourced from FactSet. Housing Starts and Permits sourced from the Commerce Department on 7/18/23—existing home sales data sourced from the National Association of Realtors on 7/20/23. Equity Market, Fixed Income returns, and rates are from Bloomberg as of 7/21/23. Economic Calendar Data from Econoday as of 7/21/23. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.