Last Week’s Markets in Review: Vaccine News Moves Equity Markets

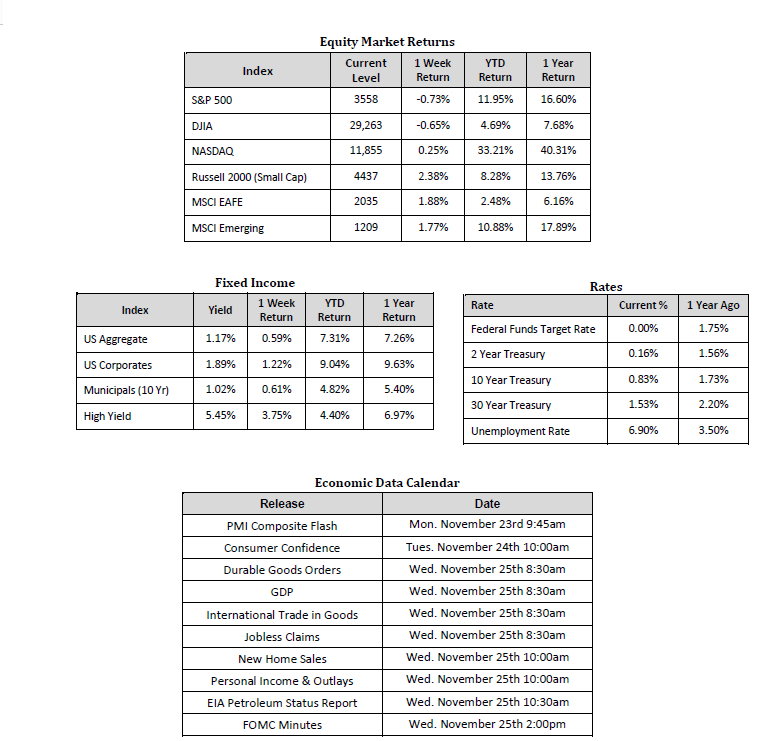

Global equity markets were mixed on the week, with large cap U.S. equities taking a backseat to their international counterparts. In the U.S., the S&P 500 Index fell to a level of 3,558, representing a 0.73% decrease, while the Russell Midcap Index pushed 1.16% higher last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 2.38% over the week. Moreover, developed and emerging international markets returned 1.88% and 1.77%, respectively. Finally, the 10-year U.S. Treasury fell to 0.83%, six basis points lower than the prior week.

Investors were once again reminded of the power of “time in the market” on Monday morning as equity markets rallied on the news that early indications pointed to a 94.5% efficacy rate for Moderna’s COVID-19 vaccine. This excellent news comes exactly a week after Pfizer and BioNTech announced that their early vaccine trials showed a 90% efficacy rate. Pfizer later confirmed it was even higher at about 95%.

It’s important to note that these are initial results, and both of these vaccines must first receive FDA approval before widespread distribution. Nonetheless, let’s take a moment to recognize the enormity of this accomplishment. Prior to the emergence of COVID-19 it could take a decade, if not longer, to develop an effective vaccine with half the efficacy of the vaccines being developed by Moderna and Pfizer/BioNTech. In fact, the vaccine many of us rely on to protect against the seasonal flu carries an efficacy rate between 40 to 60%. Therefore, developing a COVID-19 vaccine in under ten months, which is 95% effective, is truly extraordinary and should get everyone very excited about the biotechnology industry’s prospects in the coming years.

Both of these remarkable announcements on the vaccine front should serve as a reminder of the power of “time in the market” when it comes to stock investing and the importance of maintaining portfolio diversification and balance. It’s no secret that up until this point, investors have gravitated toward companies that fall under the “work from home” banner, most of which are categorized as growth. What’s more, they’ve been rewarded for doing so, which has led some investors to abandon the equity market’s value segment entirely. For evidence, we can look to the NASDAQ Index, which is primarily comprised of companies considered to be “stay at home” beneficiaries and has outperformed the S&P 500 Index by roughly 21% year-to-date. Over the last two weeks, this trend appears to have unwound somewhat as the S&P 500 Value Index has returned 5.33%, compared to a negative 0.94% return from the S&P 500 Growth Index.

What exactly is driving this trend reversal, and where should investors look for potential investment opportunities? It appears that the success of the value trade is primarily tied to the probability that an effective vaccine is widely distributed within the next six to eight months. The underlying assumption is that an effective vaccine will lead to a fully reopened economy, which will lead to increased spending following months of pent-up demand in areas of the economy that have struggled due to stay at home orders. Sectors such as materials, industrials, financials, and energy that have been the most negatively impacted by a deep, yet relatively short, recession might have the best chance at leading the new bull market that will continue to form as some semblance of normalcy returns to daily life. All of which comprise the bulk of the S&P 500 Value Index and have rallied convincingly following the Moderna and Pfizer announcements, a sign that the performance of value stocks are closely tied to the implied expectation that a widely distributed COVID-19 vaccine should enable a fully reopened economy, which should lead to above-average global economic growth.

As we move closer to FDA approval and widespread distribution of a COVID-19 vaccine, we believe it most prudent to balance exposure between growth and value. With that said, the next 12 months look very promising for U.S. stocks that fall into the value camp, given current valuations and cyclical tailwinds. Still, the potential for a negative surprise is ever-present, which is why we continue to advocate for balance and diversification above all else. For this reason, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, timeframe, and tolerance for risk.

We recognize that these are very troubling and uncertain times, and we want you to know that we are always here to help in any way we can. Please stay safe and stay well.

Other Data Sources: Equity Market and Fixed Income returns are from JP Morgan as of 11/20/20. Rates and Economic Calendar Data from Bloomberg as of 11/20/20. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology. S&P 500 sector performance represents total return figures sourced from Bloomberg.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.