Will Recent Jobs Data Influence the Fed?

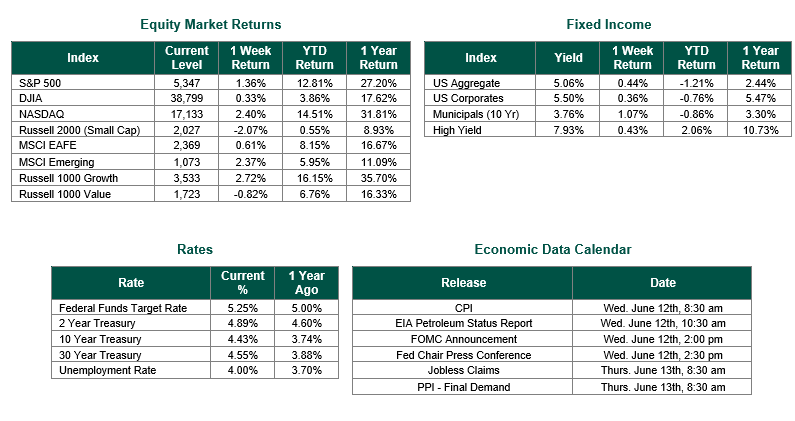

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5347, representing an increase of 1.36%, while the Russell Midcap Index moved -1.48% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.07% over the Week. As developed international equity performance and emerging markets were lower, returning 0.61% and 2.37%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.43%.

The economic news flow during the first week of June was focused on the current state of the employment market. Throughout the week, market participants reviewed and analyzed the Job Openings and Labor Turnover Survey (JOLTS) for April, Weekly Jobless Claims, and the Employment Situation report for May. We continue to follow the domestic employment environment as a key determinant of performance for the overall economy, remembering that consumers account for approximately 70% of economic activity. Consumers tend to feel more comfortable spending when they feel more comfortable about their own employment outlook.

On Tuesday, the U.S. Bureau of Labor Statistics (BLS) reported that there were 8.06 million job openings in April. This result was lower than the consensus estimate of 8.36 million openings and the prior month’s total of 8.36 million. The results showed a decline for the second month and set a new three-year low. Market participants read these results as a sign that the job market was finally starting to cool as a result of the Federal Reserve’s aggressive rate hiking campaign.

The number of Americans filing new claims for unemployment benefits increased last week, and unit Labor costs rose by less than previously reported in the first quarter. Like the JOLTS report, this data release also supported the theory that the labor market was slowing down.

However, the theme that the jobs market was cooling got somewhat upended last Friday morning as the Bureau of Labor Statistics (BLS) reported that nonfarm payrolls expanded by 272,000 during May, up from 165,000 jobs in April and well ahead of the consensus estimate of 190,000. The job gains were concentrated in areas such as health care, government, and leisure & hospitality, as these three sectors accounted for more than half of the gains for the month.

At the same time, the unemployment rate rose to 4%, the first time it has reached that level since January 2022. The unemployment rate increased as the labor force participation rate decreased to 62.5%.

We will continue to analyze employment as it factors into future monetary policy and future Federal Reserve (“Fed”) actions. The Fed will be meeting this week, but the consensus opinion is that there will be no change to interest rates announced this week, although updates to their summary of economic projections and their infamous “Dot Plot” chart may provide for a potential path forward for interest rates.

Best wishes for the week ahead!

Labor and Unemployment data is sourced from the Bureau of Labor Statistics. Economic Calendar Data from Econoday as of 6/7/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.