Last Week’s Markets in Review: Will Rising Interest Rates Hurt Equities?

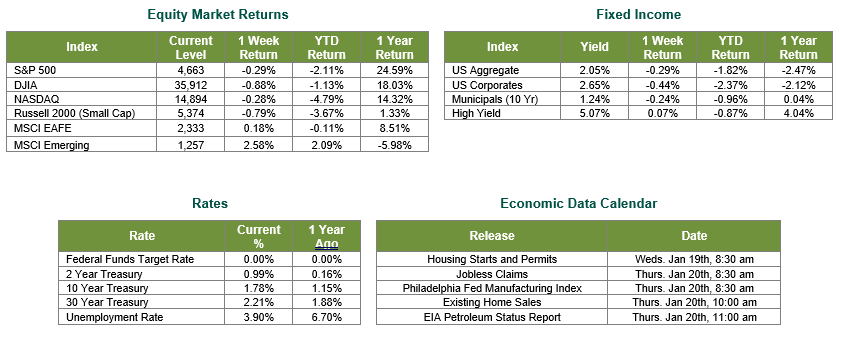

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 4,663 representing a loss of 0.29%, while the Russell Midcap Index moved 0.75% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.79% over the week. International equity performance was higher as developed, and emerging markets returned 0.18% and 2.58%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 1.78%.

The second trading week of 2022 kicked off dramatically as Fed Chair Jerome Powell answered important questions on inflation and Fed Policy during Tuesday’s second term confirmation hearing. On the inflation front, Chairman Powell reiterated that the Federal Reserve is better suited to address inflation by using its available tools (such as reducing monetary accommodations) rather than influencing demand. He also referenced that the prices for many goods have increased due to supply shortages due to supply chain constraints, which the Fed has limited ability to influence. Equity markets reacted positively, driving the S&P 500 up 1.48% on the day, following these comments.

On Wednesday, key economic data was released regarding the Consumer Price Index (CPI), which came in just below consensus expectations at a year-over-year rate of 7%. Although this figure marked the highest inflation reading in over three decades, the market digested it well as the S&P 500 Index closed seven basis points higher than the day prior. Following the CPI data, the market awaited Thursday morning’s release of the Producer Price Index (PPI) to help gauge if consumers or producers were the ones eating the costs of inflation. Similarly, the PPI data came slightly below consensus expectations but set a record with a 9.7% year-over-year increase. The PPI release came when mixed data showing weekly initial jobless claims coming in 25,000 above expectations were also released. In addition, continuing jobless claims fell to 1.559 million, the lowest such reading since 1973.

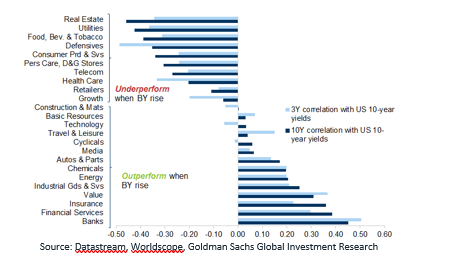

Based on Chairman Powell’s early week comments and the previously mentioned key economic data reports that were released last week, investors have been asking where to invest or if they should be invested in the equity markets. The answer is yes. As interest rates rise, the future cash flows of companies’ earnings become worth less in today’s dollars, putting pressure on the valuations of growing corporations. However, rising interest rates in certain industries will benefit earnings rather than penalize them. The chart below from Goldman Sachs Global Investment Research depicts this relationship well. Using the Financials sector as an example, as interest rates begin to rise, banks will start issuing loans at higher rates, increasing the cash flows from their lending activities. More broadly, value-oriented equities historically have tended to outperform during rising rate periods because their cash flows have a shorter time horizon and are not discounted deeply into the future like many growth-oriented equities would be.

In essence, it is still possible to generate positive equity returns during a rising rate environment, recognizing that rates generally do not rise unless economies are expanding. However, positioning within the equities market will be important as companies and industries are impacted differently. Investors may find that many areas of the market that have provided substantial returns over recent years could be the most sensitive areas to rising interest rates. For these reasons, we believe it prudent for individual investors to use this time as an opportunity to discuss their investment strategies with experienced financial professionals to help build and manage the asset allocations within their portfolios consistent with their objectives, timeframe, and tolerance for risk.

Best wishes for the week ahead!

Consumer Price Index and Producer Price Index data is sourced from the Bureau of Labor Statistics. Jobless Claims and Continuing Claims data sources from the US Department of Labor. Equity Market and Fixed Income returns are from JP Morgan as of 1/14/22. Rates and Economic Calendar Data from Bloomberg as of 1/14/22. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.