Last Week’s Markets in Review: Worried About Inflation? Consider Industrials, Materials, & Financials

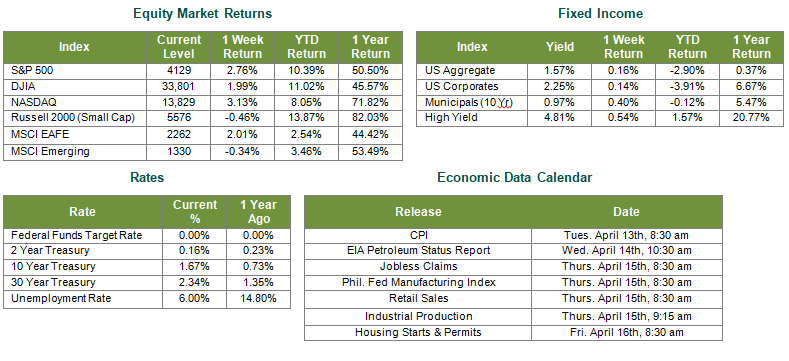

Global equity markets were mixed on the week, with U.S. equities leading international equities. In the U.S., the S&P 500 Index rose to a level of 4,129, representing a 2.76% gain, while the Russell Midcap Index followed suit, appreciating 1.54%. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, moved 0.46% lower over the week. Moreover, developed international markets moved 2.01% higher, while emerging markets fell 0.34%. Finally, the 10-year U.S. Treasury moved to 1.67%, two basis points lower than the prior week.

In last week’s update, we presented investors with a recap of the first quarter performance of three themes we’ve heralded as offering the best potential for growth in 2021: Small Cap over Large Cap, International over U.S., and Value over Growth. The common thread between these three investing themes is that they all offer more exposure to cyclical sectors that have historically outperformed the broader market during periods of above-average economic growth. Still, an added benefit that hasn’t been explicitly discussed is that these cyclical sectors may also help hedge against rapid inflation. Three sectors that have historically guarded against inflation relatively well while also capitalizing on global economic recoveries have been financials, materials, and industrials.

Industrials

Companies falling in the Industrials sector should directly benefit from the $2.2 trillion in infrastructure spending currently being discussed in Congress and likely to be passed in some form in the coming months. Efforts to rebuild America’s dated infrastructure, expand broadband access, develop nationwide infrastructure to support different forms of renewable energy, and various other construction projects should boost the bottom line of certain companies in the Industrials sector. As trillions in fiscal spending potentially lead to the general costs of goods increasing in response to above-average demand, this sector should see its constituents’ profitability rise in tandem.

Materials

Another sector that should be a direct beneficiary of a sizeable infrastructure spending package and hedge against potential inflationary pressures is the materials sector. By most standards, the price of industrial inputs like aluminum, copper, iron ore, and nickel have been depressed for the last few years, which has led to a slowdown in mining and resulted in limited supply. Limited supply combined with a pickup in construction projects should increase demand for the materials sector’s goods, boosting these companies’ bottom line even as the general cost of materials is rising.

Financials

Deconstructing nominal interest rates shows that an inflation premium is embedded in the yield of fixed income securities. As inflation expectations rise, so do interest rates generally. Historically, financials have performed very well during periods of rising rates because the spread earned on money lent increases alongside increasing rates. Moreover, many of the financial sector’s key constituents built sizeable capital positions during the pandemic that remain intact. We believe that there is a likelihood that this money will now slowly start to be returned to shareholders through increased share buybacks, increased dividends, or a combination of the two.

An over-allocation to sectors such as industrials, materials, and financials may offer the dual benefit of capturing the returns that are likely to stem from what is expected to be an incredible year for economic and earning per share growth, as well as offering a degree of protection against a potential upshot in inflation. Furthermore, with an approximately $2 trillion infrastructure bill almost certainly expected to pass through Congress in some form, we believe that adding additional exposure to the three previously mentioned sectors is worthy of consideration.

With that said, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework consistent with their objectives, time-frame, and risk tolerance.

Best wishes to all for the week ahead!

Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 4/9/21. Rates and Economic Calendar Data from Bloomberg as of 4/9/21. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index, U.S. Large Cap defined by the S&P 500. Sector performance is measured using GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than the original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.