Last Week’s Markets in Review: Certain Sectors are Leading Stocks off March Lows

Market Overview

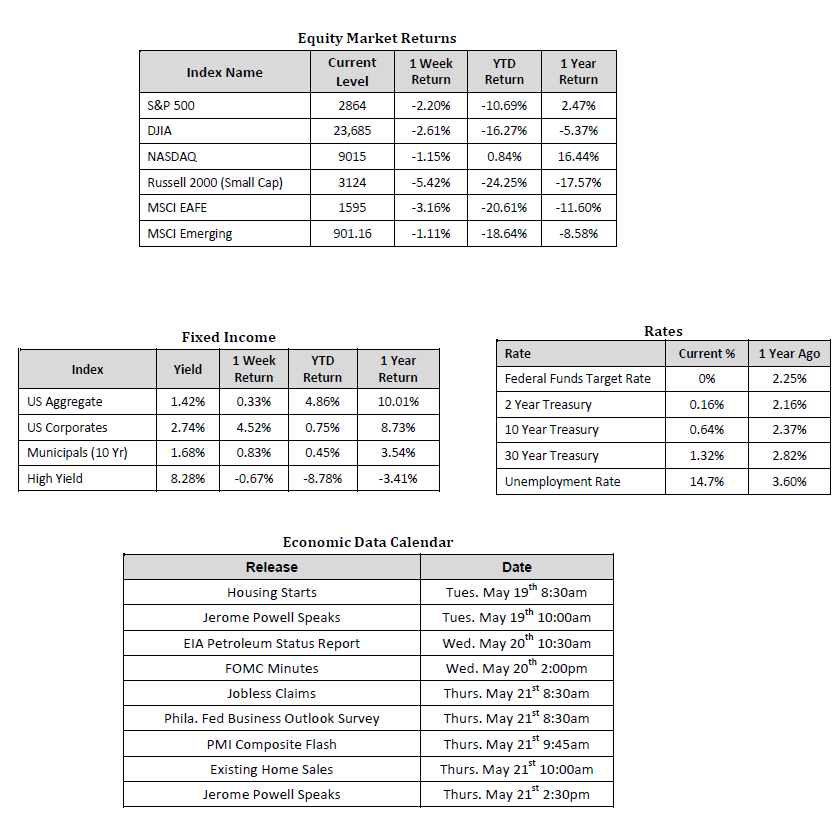

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 05/15/2020. Rates and Economic Calendar Data from Bloomberg as of 05/15/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Last week, in the U.S., stocks faltered as the S&P 500 Index fell to a level of 2,864, representing a loss of 2.20%, while the Russell Midcap Index moved 3.99% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -5.42% over the week. On the international equities front, developed and emerging markets were also pressured and gave back -3.16% and -1.11%, respectively. Finally, the yield on the 10-year U.S. Treasury fell modestly, finishing the week at 0.64%.

Following several weeks of encouraging news related to the decline of new cases and deaths attributed to COVID-19, concerns resurfaced last week on downbeat messaging from the top U.S. infectious disease expert and Federal Reserve Chairman, Jerome Powell. On Monday, Dr. Anthony Fauci warned the Senate Health Committee against reopening prematurely. Countries, states, and local governments loosening restrictions too much or too quickly could further delay an economic recovery in his opinion, which clearly worried investors. Moving over to the Federal Reserve, on Wednesday, Chairman Powell spoke to the high level of uncertainty and downside risk we, as a nation, face as we look to recover from the economic damage associated with the COVID-19 pandemic. Chair Powell continues to encourage more fiscal stimulus to help offset the economic collateral damage associated with the various restrictions and shut-down measures that were put in place to help control the spread of COVID-19. With that said, the Federal Funds Target Rate will likely be held near zero for the foreseeable future and the House of Representatives is already looking for support on an additional stimulus bill to help further curb the economic impact of COVID-19.

Further cause for concern to investors last week was the news on Thursday morning that 2.98 million Americans filed for unemployment benefits in the week ending May 9. This was weaker than expected and brought the total to $36+ million over the past 2 months.

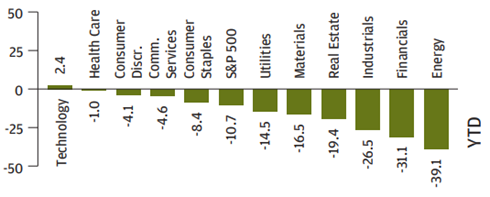

Up until this point, the strong market recovery from the March lows has not been your typical cyclical rally. Cyclical stocks and their associated companies have a direct relationship to the economy and the business cycle. It’s easy to assume when looking at the S&P 500 Index, an index widely recognized as a barometer of the U.S. economy as a whole, that this has been a broad-based rally. However, that’s not necessarily the case upon further review of the sectors and industries leading the way thus far. In the chart below, one can see there are clear leaders within the S&P 500 Index such as Information Technology, Healthcare, and Consumer Discretionary. As it stands today, S&P 500 Index company stock concentration is extremely high, with the five largest stocks representing 21% of the index. These names include Microsoft, Apple, Amazon.com, Facebook, and Alphabet, all of which are large-cap companies with relatively strong balance sheets. In addition, consider that the performance of the technology-laden NASDAQ Composite turned positive on a total return basis for the year at one point last week.

Source: J.P. Morgan

On the flip side, traditional cyclical sectors including Industrials, Materials, Financials, and Real-Estate have lagged considerably thus far this year. There even exists a disparity within certain sectors that shows the pattern of technology vs. traditional cyclicality. For example, within the consumer discretionary sector, the sub-industry Internet Retail & Direct Marketing is up 20.3% year-to-date while the Apparel Accessories & Luxury Goods sub-industry is off nearly 50%. It will be encouraging when we see increased production and demand for a broader range of products and services spanning multiple industries. Positive developments in those cyclical sectors would help show the recovery rebound is strong and potentially sustainable. However, we still believe that the COVID-19 pandemic has likely triggered a lasting societal and economic paradigm shift, accentuating a trend that has already been accelerating in the areas of Technology (not necessarily limited to the tech sector), Medicine, and Commerce. For these reasons, we believe that the current sector leaders have the ability to persist in the months and years ahead.

A well-rounded portfolio typically involves allocations to various sectors and asset classes that contribute differently to risk and return potential. As a result, we encourage investors to stay disciplined and work with experienced financial professionals to help manage their portfolios through various market cycles within an appropriately diversified framework that is consistent with their objectives, time-frame, and tolerance for risk.

We recognize that these are very troubling and uncertain times and we want you to know that we are always here for you to help in any way that we can.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against loss. Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.