Markets Anticipate a Rate Cut from the Fed

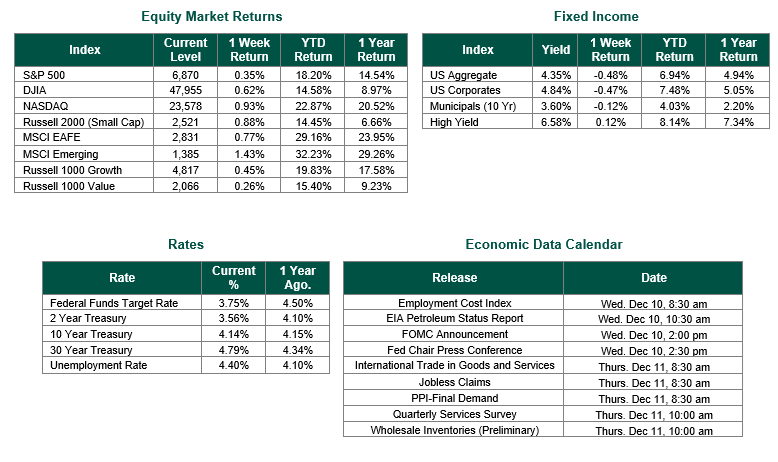

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6870, representing an increase of 0.35%, while the Russell Midcap Index moved +1.00% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.88% over the week. As developed international equity performance and emerging markets were positive, returning 0.77% and 1.43%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.14%.

During the first week of December, U.S. economic data flow reports painted a picture of an economy still expanding but losing some momentum. For example, the S&P Global manufacturing PMI for November remained above 50, signaling continued growth in factory activity. However, the index eased from the prior month, indicating that the pace of expansion had slowed, and that new orders and output were softening, even as manufacturing employment held up. The ISM manufacturing index, by contrast, had been running below 50 in the most recent report before that week, underscoring ongoing contractionary pressure in parts of the industrial sector, with sub-indices for new orders, production, and employment all pointing to weaker demand and output, despite still-elevated cost pressures.

On Friday, December 5, 2025, a cluster of data releases focused attention on household conditions: delayed personal income and outlays data provided an update on wage and salary growth, consumer spending, and the Fed’s preferred PCE price index, which continued to show inflation running somewhat above the 2 percent target even as monthly price gains were relatively contained. Alongside that, the University of Michigan’s November consumer sentiment reading remained historically weak, with households reporting strained personal finances and poor buying conditions, despite slightly lower near-term inflation expectations. These results reinforce the message that high prices and slower income growth were weighing on confidence, even as overall economic activity and employment continued to expand.

Looking forward to the Federal Open Market Committee this week, the Federal Reserve will meet on Tuesday and Wednesday. Market sentiment implied a strong expectation that the Fed would reduce the federal funds rate rather than leave it unchanged. The probabilities derived from futures prices and summarized by the CME FedWatch framework showed a dominant market view that a 25 basis point (0.25%) rate cut was the most likely outcome, with estimates in external analyses putting the chance of a cut at roughly 88%, versus a much smaller probability assigned to holding the target range steady. These probabilities reflected traders’ interpretation of softening economic data and more dovish signals from policymakers. It will also be interesting to receive new economic projections from the Federal Reserve, as well as a new Dot Plot Chart, which will show where interest rates may head in 2026.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 12/5/25. November PMI data was sourced from S&P Global. The ISM Manufacturing Index was sourced from The Institute for Supply Management. Personal income and outlays data and PCE are supplied by the Bureau of Economic Analysis. Consumer Sentiment for November is sourced from the University of Michigan. Fed funds futures was sourced from CME’s FedWatch. Consumer Confidence Index was sourced from the Conference Board. Employment Data was sourced from the Bureau of Labor Statistics. Calendar Data from Econoday as of 12/5/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.