Markets Move Higher as Shutdown Continues

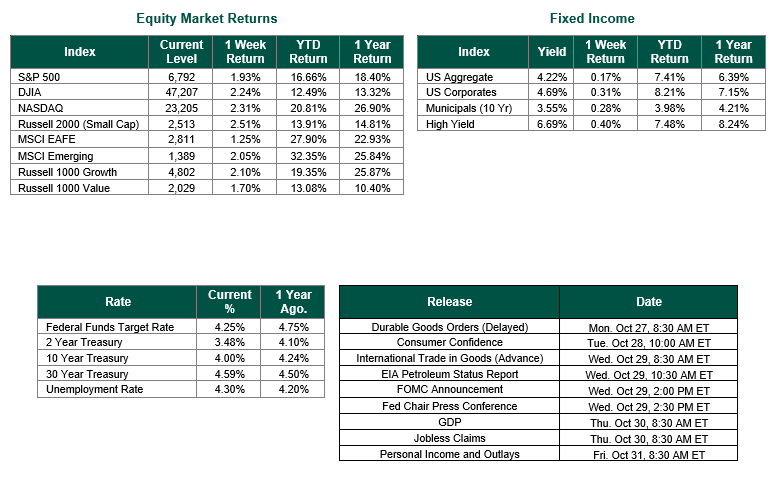

Global equity markets finished up for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,792, representing a gain of 1.93%, while the Russell Midcap Index moved +0.03% last week. Meanwhile, the Russell 2000 Index, a measure of the nation’s smallest publicly traded firms, returned 2.51% over the week. Developed international equity performance and emerging markets were mixed, returning 1.25% and 2.05%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly higher, closing the week at 4.00%.

U.S. stock indexes advanced last week, overcoming volatile U.S.-China trade headlines and a surge in oil prices after U.S. sanctions hit Russia’s top oil companies. Early gains came from strong bank earnings, notably JPMorgan Chase and Wells Fargo, though tech stocks faced midweek volatility over potential Chinese software export curbs. Despite the ongoing government shutdown delaying key economic data, the Bureau of Labor Statistics (BLS) released September inflation numbers last week, primarily to account for the necessary cost-of-living adjustments for Social Security in 2026. Headline inflation rose to 3.0% from 2.9%, below Bloomberg’s 3.1% forecast, while core inflation, excluding food and energy, held at 3.0%, down slightly from August. These lower inflation results fueled a Friday rebound, supporting expectations for Fed easing, with markets pricing a 96% chance of a 25 basis point cut to 3.75%-4.00% at this week’s upcoming FOMC meeting.

The University of Michigan’s final October Consumer Sentiment Index was also released last week, and showed a dip to 53.6 from 55.1, a five-month low, driven by rising inflation concerns despite steady personal finance views. Year-ahead inflation expectations also increased to 4.8% from 4.6%, with long-run expectations steady at 3.7%. Federal government shutdown mentions remained low, at 2% of respondents.

With the Government shutdown delaying many of the important economic indicators we would typically focus on, investors have focused most of their attention on corporate earnings. FactSet projects S&P 500 earnings growth at a solid level of 8.5%, extending a ninth consecutive quarter of gains. Finally, the Federal Reserve’s September minutes, released amid data scarcity, showed policymakers noting progress toward 2% inflation but flagging employment risks, with most favoring further rate cuts this year, though some urged caution. The ongoing shutdown, potentially lasting through month-end, continues to disrupt data flows and shape policy expectations, and could ultimately have an impact on Q4 economic growth if it continues much longer.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 10/24/25. Corporate Earnings Data was sourced from FactSet. Economic Calendar Data from Econoday as of 10/27/25. CPI data sources from the Bureau of Labor Statistics on 10/24/25. Consumer Sentiment sourced from the University of Michigan on 10/24/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.