Markets Navigate Mixed Economic Signals

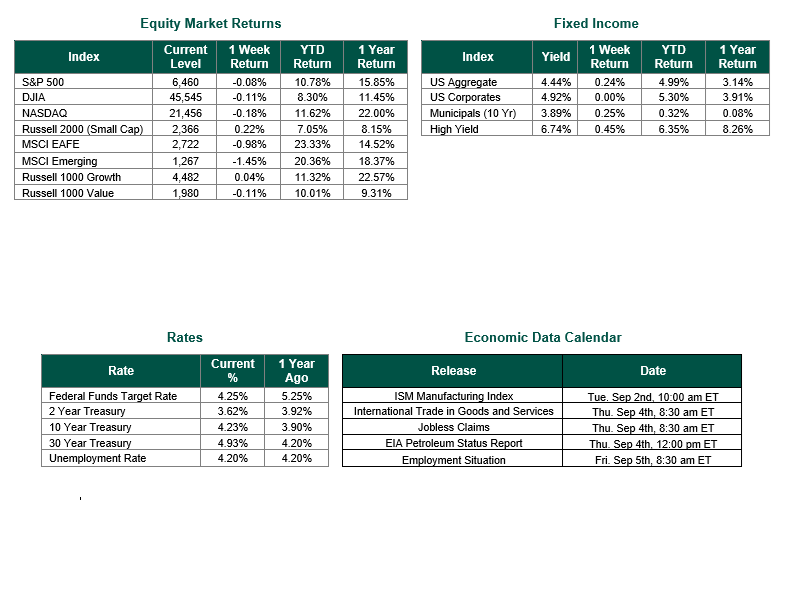

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,460, representing a loss of 0.08%, while the Russell Midcap Index moved down 0.11% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.22% over the week. Developed international equity performance (MSCI EAFE) and emerging markets (MSCI EM) were -0.98% and -1.45%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly lower, closing the week at 4.23%.

Last week was packed with an abundance of economic data prints that would shape the market ahead of the holiday weekend. July new home sales dipped 0.6% to a seasonally adjusted annual rate of 652,000 units, missing expectations. This result follows a revised June figure of 656,000, up from 627,000. Year-over-year, sales are down 8.2%, reflecting affordability challenges with the median home price at $403,800, a 5.87% drop from last year. High mortgage rates and cautious buyers continue to pressure the housing market.

The Consumer Confidence Index fell to 97.4 in August from 98.7 in July, driven by growing unease about the jobs market. While consumers remain cautiously optimistic about future income, persistent labor market worries are dampening sentiment, potentially impacting spending trends. However, to the contrary, initial jobless claims for the week ending August 23 fell to 229,000 from 234,000, outperforming forecasts. Continuing claims also dropped to 1.954 million, below the expected 1.966 million. These figures point to a still-tight labor market, with layoffs remaining low despite economic headwinds, offering some reassurance amid mixed signals.

The second-quarter gross domestic product (GDP) growth was revised last week to a robust 3.3% annualized rate, which is up from the initial 3% estimate. Stronger business investment and consumer spending fueled the upward revision, painting a relatively resilient economic picture. This growth suggests businesses and households are adapting to higher interest rates, though sustainability remains a question. And lastly, the Personal Consumption Expenditures Index (PCE) rose 0.2% on a month-over-month basis and 2.6% year over year – both meeting expectations. As a reminder, PCE is the Federal Reserve’s preferred measure of inflation, and the latest reading suggests that inflation does remain somewhat persistent, although consumer spending remains resilient. The latest print did not shake the market’s expectations for an interest rate cut when the Fed meets this month, with CME Group still projecting a 25 bps cut with 90% certainty.

The past week’s data presents a mixed but resilient economic landscape. Strong GDP growth and low jobless claims highlight underlying strength, while softening home sales and consumer confidence reflect caution. Rising personal income and spending suggest consumers are still driving growth, but declining savings and job market concerns could temper optimism. Policymakers and investors will watch closely as these trends shape the economic outlook for Q3 2025.

We hope everyone enjoyed a nice Labor Day weekend and wish you the best for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 8/29/25. Economic Calendar Data from Econoday as of 9/2/25. New Home Sales sourced from the U.S. Census Bureau on 8/26/25. Consumer Confidence sourced from the Conference Board on 8/28/25. GDP and PCE sourced from the Bureau of Economic Analysis on 8/29/25. Jobless Claims sourced from the U.S. Department of Labor on 8/28/25.International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.