Markets Rise on Economic Optimism

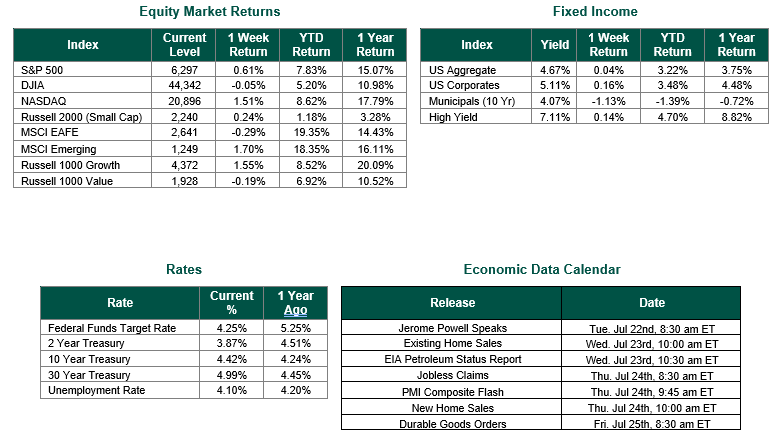

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,297, representing a gain of 0.61%, while the Russell Midcap Index rose 0.30%, closing at approximately 3,751. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.24% over the week, closing at 2,240. Developed international equity performance and emerging markets were mixed, returning -0.29% and 1.70%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.42%.

The U.S. stock market showed resilience last week, with major indices posting modest gains despite ongoing trade policy uncertainties, reflecting cautious optimism driven by a combination of strong economic data and corporate earnings. Markets continue to navigate tariff concerns, with new deadlines extended to August 1, allowing more time for trade negotiations with key partners like the European Union (EU) and Mexico.

Economic indicators painted a robust picture last week. June retail sales surged 0.6%, surpassing expectations of 0.2%, signaling sustained consumer spending, which is an important driver of economic growth. Jobless claims dropped to 221,000 for the week ending July 12, down 7,000 from the prior week, underscoring labor market strength. Inflation remained relatively stable, with the Consumer Price Index (CPI) rising 0.3% month-over-month and 2.7% year-over-year, which was in line with forecasts, though above the Federal Reserve’s target. The Producer Price Index (PPI) showed a modest 2.3% annual increase, slightly below expectations, suggesting contained inflationary pressures.

Corporate earnings for Q2 have exceeded expectations thus far, with 83% of reporting S&P 500 companies surpassing analyst EPS estimates, which was above the 10 year average of 75%, according to FactSet. This optimism supports expectations of high-single-digit growth for 2025, potentially accelerating to double digits in 2026 if interest rates ease and trade uncertainties subside. The Federal Reserve’s stance remains cautious, with a 60% probability of a rate cut by September, according to CME Group. However, no immediate action is anticipated following the upcoming FOMC meeting in July due to steady inflation and a strong labor market.

Geopolitical and trade developments continue to influence investor sentiment. The extension of tariff deadlines tempered fears of immediate economic disruption. Investors are focused on upcoming earnings from major firms and key economic releases. Looking ahead,while the longer term outlook seems promising, investors should brace for the possibility of some short-term bouts of volatility as trade talks progress and the Fed’s rate path uncertainty continues.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 7/18/25. CPI and PPI data sourced from the Bureau of Labor Statistics on 7/15/25 and 7/16/25, respectively. Jobless claims sourced from the U.S. Department of Labor on 7/18/25. Calendar Data from Econoday as of 7/21/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.