Monetary and Fiscal Stimulus to Help Stem Longer Term Economic Fallout

Market Overview

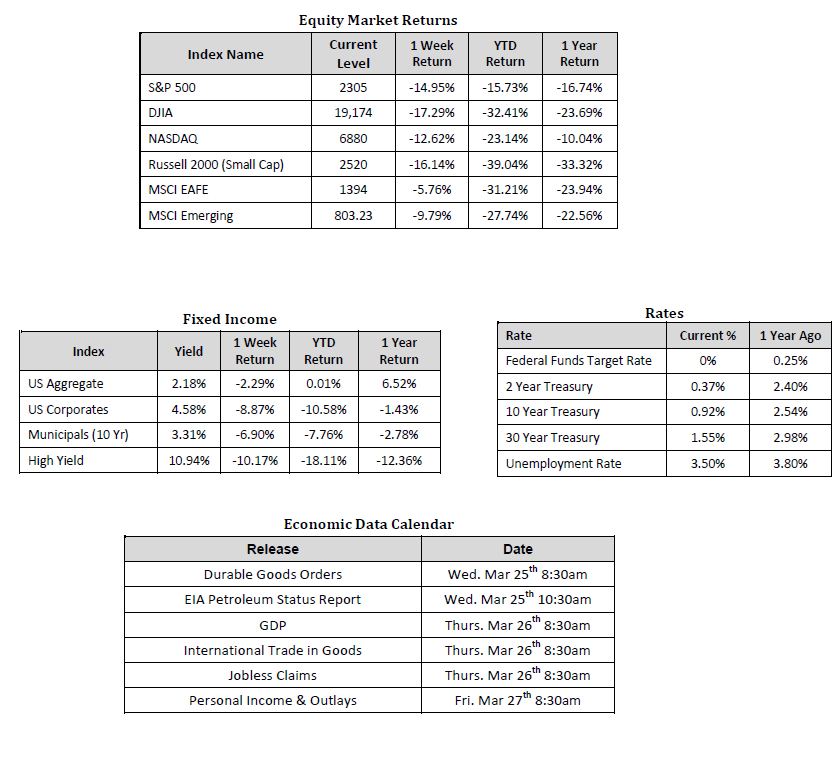

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 03/20/2020. Rates and Economic Calendar Data from Bloomberg as of 03/20/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

Global equity markets moved decisively lower last week. In the U.S., the S&P 500 Index moved into bear market territory and finished the week at a level of 2,305, representing a 14.95% loss, while the Russell Midcap Index retreated 18.13%. The Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -16.14% over the week. On the international equities front, both developed and emerging markets also finished in the red for the week, returning -5.76% and -9.79% respectively. Finally, the 10-year U.S. Treasury yield settled in at 0.92%, little changed from the previous week.

There wasn’t a major asset class that was able to avoid last week’s sell-off as equities, fixed income, and commodities alike felt the pressure. Investors fear the unknown, which in this case refers to the length and magnitude of the impact that the novel coronavirus will have on the global economy. Medical expert forecasts vary widely for peak cases. Even major research houses are speaking more openly about the uncertainty in their projections. All they can do is model several scenarios and look for indicators of how this will unfold as more data comes in.

However, it is also important to consider what is known. While the time-frame for the virus in our country is currently unclear, it is clear that the federal government, local governments, and private industries are doing everything in their respective powers to help limit the impact of the virus on human life and the economy as a whole. First, let’s look to the Federal Reserve (“Fed”) who has stated and proved they are committed to supporting households, businesses, and the economy as a whole through these challenging times. The following are some of the more pronounced examples of the robust support being provided by the Fed.

• Cut the Federal Funds Target Rate to a range of 0.00% – 0.25%

• Implemented a new $700 billion quantitative easing program through the purchase of U.S. Treasuries and mortgage-backed securities to provide liquidity to the market

• Announced they will be purchasing an “unlimited amount” of U.S. Treasuries and mortgage-backed securities and now also purchasing agency commercial mortgage-backed securities as part of an expansion of its overall asset purchase program.

• Launching a commercial paper facility to help limit breakdowns in this critical area of financing for many companies

• Plan to launch new lending facilities aimed at supporting corporate credit markets

Keep in mind that the list above is only related to the U.S. central bank. Central banks around the globe have also made similar commitments and put in place a tremendous amount of support for their respective economies and businesses.

Fiscal policy will also play a vital role in aiding businesses and the American people. Bi-partisan spending packages have already been put into place, providing over $100 billion in support and resources to agencies such as the CDC and FDA, as well as providing aid to businesses and employees affected by the massive disruption. Focus is now back on Washington and a proposed stimulus plan, which is expected to deploy nearly $2 trillion worth of aid. Unfortunately, the U.S. Senate failed to ratify two iterations of the plan at the time of this writing. Although the news may have been a disappointment, and markets reacted accordingly, there are a few bright spots. The amount of stimulus has doubled since early talks, and this is a bi-partisan effort as both parties recognize the need but are currently not agreeing on deployment and terms. Discussions and negotiations continue in the Senate and we are told that they are getting closer and closer to making a deal. [UPDATE: The Senate and White House agreed to a $2 trillion relief bill after midnight early Wednesday morning. The House will now vote on the proposal.]

What does this mean for markets and investors? We will get through this as we have other financial downturns remembering that this time is different than many other downturns as this is an event-driven sell-off as opposed to a fundamentally driven market collapse (see last week’s market update for more details). Support systems are being put in place and we could see a stark rebound in business activity, and in turn stock prices, during the latter stages of the second half of the year provided that the pandemic is behind us at that point. Numerous studies show that trying to time the market is detrimental to long-term portfolio performance so we encourage investors to resist the temptation to try and time when to exit and re-enter the market and instead revisit and reassess their financial plan, investment strategies and current asset allocation with experienced financial professionals. As always, we stand ready to help provide guidance and perform any investment portfolio or financial plan reviews.

Important Information and Disclaimers

Disclosures: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.