Q3 Earnings Season is off to a Good Start

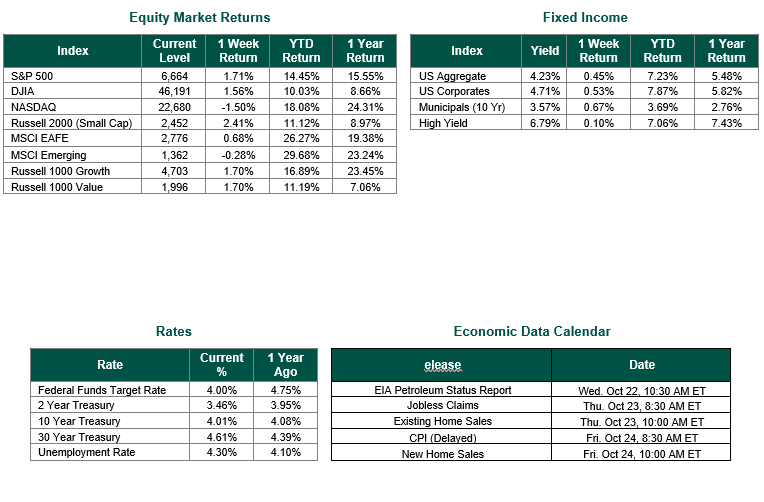

Global equity markets finished up for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,664.01, representing a gain of 1.71%, while the Russell Midcap Index moved +0.03% last week. Meanwhile, the Russell 2000 Index, a measure of the nation’s smallest publicly-traded firms, returned 2.41% over the week. Developed international equity performance and emerging markets were mixed, returning 0.68% and -0.28%, respectively. Finally, the 10-year U.S. Treasury yield moved slightly higher, closing the week at 4.01%.

The United States federal government remains in a prolonged shutdown—now marking its twentieth day and becoming the third-longest shutdown in U.S. history. The focus of the gridlock between Republicans and Democrats seems to focus on spending levels, foreign aid rescissions, and healthcare subsidies. As of October 20, the Senate prepared for its 11th vote on a funding measure, with few signs of a compromise emerging.

Federal Reserve Chair Powell delivered a keynote address at the National Association for Business Economics (NABE) meeting last Tuesday. Within this address, Chair Powell reaffirmed the central bank’s commitment to data-driven and independent decision-making, emphasizing that the Fed will not follow a predetermined path for interest rates but will respond flexibly to evolving economic conditions. He also acknowledged growing scrutiny of the Fed’s actions but stressed the importance of maintaining public trust by avoiding political influence and focusing on long-term economic stability. Financial markets interpreted his comments as a signal of a likely 25-basis-point rate cut at the upcoming policy meeting next week, with the possibility of another rate reduction in December. Combined, these cuts would represent a gradual move towards the Fed’s stated neutral policy rate of 3% amid a delicate balance between inflation risks and employment concerns.

According to FactSet’s latest Earnings Insight report (October 17, 2025), third quarter 2025 corporate earnings for the S&P 500 are showing steady momentum, led in large part by strength in the financials sector. Through mid-October, 12% of S&P 500 companies had reported actual results. Of these, 86% surpassed earnings-per-share (EPS) expectations, and 84% beat revenue estimates. The blended year-over-year earnings growth rate for the S&P 500 currently stands at 8.5%, up from 7.9% projected at the end of Q3. If this forecast proves true, it would mark the ninth consecutive quarter of earnings expansion for the index. FactSet also noted that seven of the eleven S&P 500 sectors are posting positive year-over-year results thus far, with the financial, information technology, utilities, and materials sectors leading the way.

The financials sector stands out as the primary engine behind the quarter’s upside surprises at this early state of earnings eason. Its blended earnings growth rate surged to 18.2%, up sharply from 13.2% the previous week and 11.4% at the close of September. FactSet attributes this improvement to substantial EPS surprises from major banks. These results significantly lifted both the index’s blended earnings and its revenue growth rates, which rose to 6.6% from 6.3% at quarter-end. The sector’s revenue growth also advanced to 8.1%, reflecting stronger credit activity, insurance underwriting, and investment banking performance. We will continue to monitor and analyze corporate earnings results and any progress on Capitol Hill.

Best wishes for the Week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 10/17/25. Corporate Earnings Data was sourced from FactSet. Economic Calendar Data from Econoday as of 10/17/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.