Last Week’s Markets in Review: Rally Continues Through Mixed Economic Data

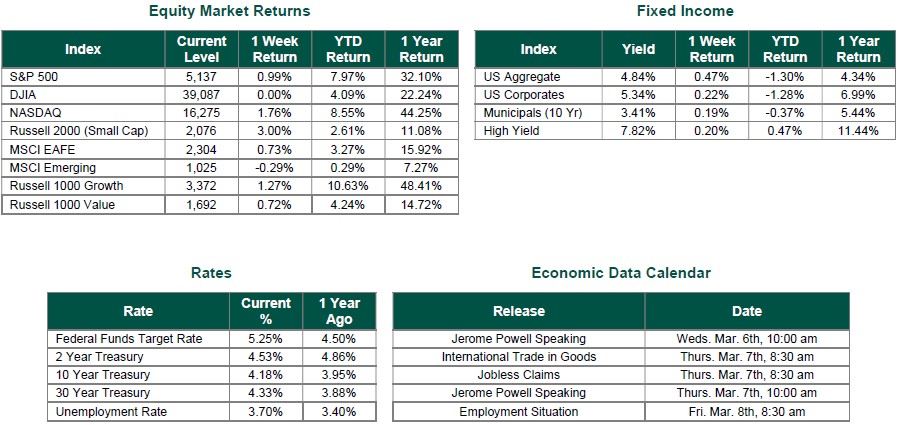

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the Week at a level of 5,137, representing an increase of 0.99%, while the Russell Midcap Index moved 1.64% last Week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 3.00% over the Week. As developed international equity performance and emerging markets were mixed, returning 0.73% and -0.29%, respectively. Finally, the 10-year U.S. Treasury yield moved lower, closing the Week at 4.18%.

The Commerce Department reported on durable goods orders for January. The report showed that orders for long-lasting manufactured goods fell by the most (6.1%) in nearly four years amid a sharp drop in commercial aircraft. These results may suggest the economy lost some momentum at the start of the year. Also, on Tuesday, markets digested the latest reading for consumer confidence. The Conference Board reported that its consumer confidence index for February slipped to 106.7 from 110.9 in January. The consensus estimate for the index was 115.0. These results were also interpreted as signs of a slowing economy.

The second estimate of the fourth quarter gross domestic product (GDP) was reported on Wednesday. The 3.2% annual pace reported slightly decreased from the first estimate of 3.3%. Domestically, the economy has topped 2% growth for six straight quarters, defying fears that high interest rates would tip the world’s largest economy into a recession. However, the long-awaited economic slowdown does now appear to be taking shape as the most recent GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) from the Federal Reserve Bank of Atlanta in the first quarter of 2024 is 2.1% as of March 1st, down from 3.0% on February 29th.

Weekly jobless claims rose by more than expected for the week ended February 24th, according to a report released by the Labor Department last Thursday. Any weakness in the labor market provides further validation that the economy is slowing.

Finally, the Bureau of Economic Analysis released the most important data of the week on Thursday. The personal consumption expenditures price index (PCE) for January increased 0.3% monthly and 2.4% on a 12-month basis, in line with consensus estimates. The report also reported Core PCE (excluding food and energy costs) increased 0.4% for the month and 2.8% from a year ago, as expected by the analyst community. The annual increase in inflation was the smallest in three years, keeping a potential mid-year interest rate cut from the Federal Reserve on the table.

After investors digested all the data above, the S&P 500 & NASDAQ indexes moved to new record highs last week.

Best wishes for the week ahead!

Both Durable goods orders and GDP are sourced from The Commerce Department. Jobless claim are sourced from The Labor Department. Personal consumption expenditures price index is sourced from the Bureau of Economic analysis. Economic Calendar Data from Econoday as of 2/20/24. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.