Resilience vs. Uncertainty

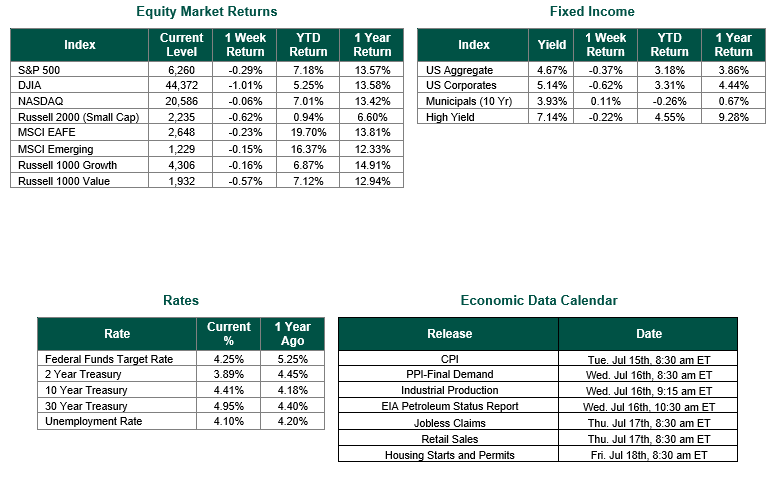

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,260, representing a decrease of 0.29%, while the Russell Midcap Index moved -0.6% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.62% over the week. As developed international equity performance and emerging markets were down, returning -0.23% and -0.15%, respectively. Finally, the 10-year U.S. Treasury yield moved up, closing the week at 4.41%.

Last week was marked by heightened volatility across global markets as investors grappled with renewed trade tensions and mixed economic signals. U.S. stocks initially surged to record highs, buoyed by a strong employment environment and optimism around AI-driven tech earnings, with Nvidia nearing a $4 trillion valuation. However, sentiment quickly shifted after the current Administration reignited tariff threats, announcing 25% levies on imports from Japan and South Korea and warning of additional penalties for BRICS-aligned nations. This triggered a broad market pullback, with the Dow falling over 400 points and trade-sensitive sectors like industrials and consumer goods under pressure. The Federal Reserve released minutes hinting at a cautious stance on future rate cuts. The dollar strengthened on tariff concerns, and Treasury yields rose as inflation fears resurfaced. The U.S. national revenues for June 2025, as reported by the Congressional Budget Office on July 11, 2025, totaled approximately $466.3 billion, marking a notable increase from the prior month. The revenue boost was driven by higher wages, increased payroll tax collections, and elevated customs duties following new tariff policies.

Overall, the week underscored the market’s sensitivity to geopolitical developments and the delicate balance between economic resilience and policy uncertainty.

Looking forward, corporations will begin to report their earnings for the second quarter this week. Big banks and a few other influential companies will fill the week. Early reports include Johnson & Johnson (JNJ: NYSE), PepsiCo (PEP: NASDAQ), Netflix (NFLX: NASDAQ) and Taiwan Semiconductor (TSM: NYSE). These reports could set the tone for the broader market, especially with banks leading the way.

Best wishes for the Week ahead.

Equity and Fixed Income Index returns sourced from Bloomberg on 7/11/25. National Revenue Data sourced from the Congressional Budget Office. Economic Calendar Data from Econoday as of 7/11/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.