Resilient Consumers Help Boost U.S. Growth

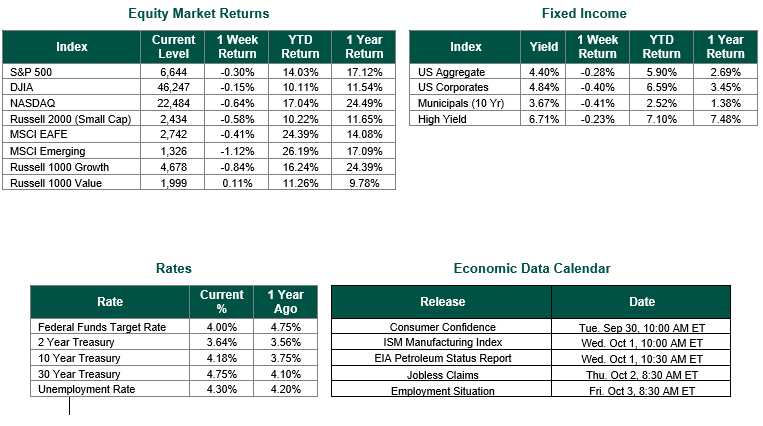

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,644, representing a –0.30% move, while the Russell Midcap Index moved –0.30% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned –0.58% over the week. As developed international equity performance and emerging markets were mixed, returning –0.41% and –1.12%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.18%.

Recent data that came in last week indicated a robust U.S. economy with second-quarter GDP growth being revised to 3.8% (on an annualized basis), surpassing forecasts of 3.3%. Consumer spending, typically accounting for ~70% of GDP growth in the U.S., hit 2.5%, also exceeding expectations of 1.7%. August data continued this trend, with personal income up 0.4% (vs. 0.3% forecast) and real personal spending at 0.4% (vs. 0.2% forecast), signaling sustained consumer strength. The Atlanta Fed’s GDP-Now model projects third-quarter growth at an impressive 3.9%, driven by 3.4% consumption.

The labor market also showed some stabilization despite recent cooling. Weekly jobless claims dropped below expectations, suggesting that the post-Labor Day spike was potentially an outlier. However, this upcoming week’s job figures should provide more clarity. Inflation, measured by PCE, aligned with forecasts in August: headline at 2.7% and core at 2.9%, below the Fed’s 2025 estimates of 3.0% and 3.1%, respectively, but above its 2.0% target.

A U.S. government shutdown looms this upcoming week on October 1st if Congress fails to pass funding measures. Historically, shutdowns cause short-term economic slowdowns but quick recoveries. Political rhetoric may spark market uncertainty and short-term volatility, but any long-term economic or market impact should be limited.

The U.S. economy currently remains strong, driven by resilient consumers and continued investment in artificial intelligence (AI)-related infrastructure projects. While risks like a government shutdown or a market pullback exist, solid fundamentals suggest these should be temporary. We will continue to monitor labor market trends and inflation data as the Federal Reserve prepares for its October interest-rate decision.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 9/26/25. GDP and PCE Data sourced from the Bureau of Economic Analysis on 9/25/25 and 9/26/25, respectively. Jobless claims sourced from the U.S. Department of Labor on 9/26/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.