Shutdown Ends and Volatility Begins

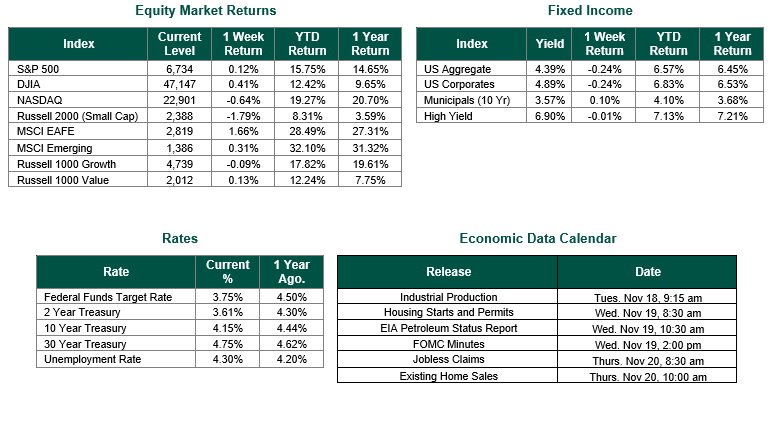

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6734, representing an increase of 0.12%, while the Russell Midcap Index moved -1.61% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.79% over the week. As developed international equity performance and emerging markets were positive, returning 1.66% and 0.31%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.15%.

Last week, the U.S. Federal Government shutdown—which had started on October 1—reached its conclusion after lasting a record 43 days, ending on November 12 when President Trump signed a compromise funding bill. Major developments included tense negotiations in Congress, repeated failure give of funding bills, and critical delays in federal payments, such as SNAP benefits. Throughout the week, optimism grew after the Senate advanced a bill late Sunday (Nov 9), and by November 12 the House passed the compromise, funding the government through January 30, 2026. Reopened federal services alleviated short-term market concerns, but risks persisted due to pent-up demands and ongoing uncertainty.

Each week of the shutdown subtracted about 0.1% from annualized GDP growth, attributed mainly to reduced government activity and a transmission channel through declining sentiment and productivity. Aggregate losses over the six-week shutdown were estimated to reduce annual GDP growth by approximately 0.6%. While most furloughed employees received back pay under the bill, the broader spending halt disrupted associated private sector incomes and investments, amplifying economic drag. October saw a modest job increase (42,000 new jobs) slightly surpassing expectations, but broader labor market data was delayed due to suspended operations at federal agencies like the Bureau of Labor Statistics. Threatened layoffs, actual furloughs, and delayed paychecks affected both direct federal workers and contractors, with ripple effects in sectors relying on government activity. Many economic reports (payrolls, unemployment) were postponed, creating an information gap for policymakers and markets.

U.S. consumer sentiment sharply declined. The University of Michigan’s index dropped to 50.3, its lowest since mid-2022. Driven by prolonged shutdown anxieties and persistent inflation. Lower-income households felt acute impacts as the loss of public assistance combined with growing pessimism over economic outlook. Even higher-income groups showed diminished optimism due to stagnating job growth and broader policy uncertainty. Elevated short-term inflation expectations (4.7%) added to household stress as spending and savings patterns shifted during the shutdown.

Multiple Federal Reserve Board of Governors made public comments during the week. The comments reflected cautious optimism, ongoing concerns about inflation, and a growing willingness to support further interest rate cuts given economic data and lingering effects from the recent government shutdown. Governors, Christopher Waller and Stephen Miran, signaled readiness to back more aggressive easing due to apparent weaknesses in the labor market and persistent inflationary pressures, but also highlighted that projections beyond current cuts remain highly uncertain. Miran in particular advocated for a larger rate reduction than consensus, citing evidence from bond markets supporting his view that substantial easing is warranted to manage both employment and inflation risks.

The reopening of the federal government marks an important step toward stabilizing the U.S. economy and restoring confidence among consumers and businesses. However, as policymakers and central bankers shift their focus to lingering concerns, persistent inflation and delayed economic indicators from the shutdown are likely to influence monetary policy for months to come. Federal Reserve officials have expressed both optimism and caution, balancing the need for stimulus with a commitment to price stability. As the effects of the shutdown continue to reverberate through GDP, labor markets, and consumer sentiment, the coming weeks will reveal whether the government’s resolution and potential actions by the Federal Reserve can rebuild sustained momentum in growth and public confidence.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 11/14/25. Interest Rate Data is sourced from The Federal Reserve. Economic Consumer Sentiment Index was sourced from the University of Michigan. Employment Data was sourced from the Bureau of Labor Statistics. Calendar Data from Econoday as of 11/14/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.