Stocks Drop Ahead of Irma but then Bounce Back

Market Overview

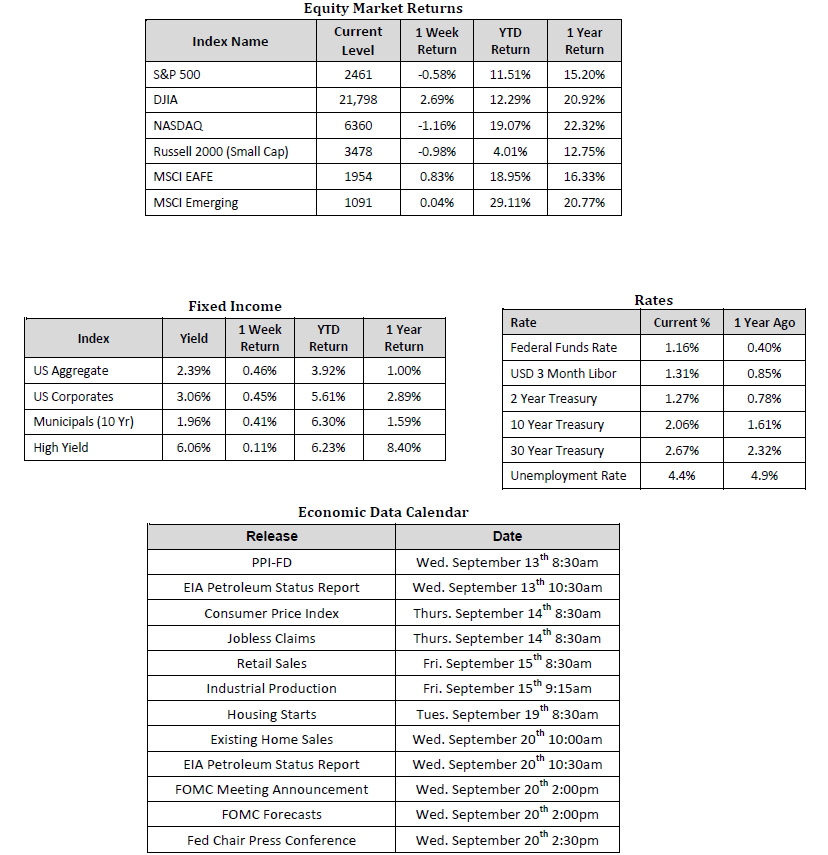

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 9/08/17. Rates and Economic Calendar Data from Bloomberg as of 9/12/17. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology. S&P 500 earnings data from Factset as of 9/08/17.

Happening Now

Stock markets around the world posted mixed results last week as the U.S. prepared for Hurricane Irma and considered the potential for another missile test from North Korea. The S&P 500 Index dropped 0.6%, the Russell Midcap Index fell 0.7%, and the Russell 2000 Index, a gauge of small cap stocks, declined 1.0%. On Monday, however, U.S. markets quickly reversed course by gaining over 1%, providing yet another sign of the resiliency of this particular bull market run. International stocks also displayed their diversification benefits last week with developed markets gaining 0.8% and emerging markets finishing essentially flat with a 0.04% move higher.

A cautious tone was taken last week as Hurricane Irma, then a Category 5 storm and the strongest ever to form in the open Atlantic Ocean, took direct aim at Miami. Insurers sold off as evidenced by the SPDR S&P Insurance ETF’s (Ticker: KIE) fall of nearly 3% on the week as estimates for damages soared to $200 Billion. The humanitarian toll is not to be understated – lives were lost, thousands displaced, and homes ruined. The economic impact, however, appears to now be a fraction of the initial estimates. The damages caused by Irma and Harvey certainly have weighed on local economies and may have short term effects on national economic data but we do not believe they will have a lasting impact. We continue to suggest that we are in the expansionary phase of the business cycle and expect the secular bull market to continue. This sentiment appears to be shared by other investors as well considering the S&P 500 Index rebounded by gaining over 1.0% during Monday’s trading session.

In addition to Mother Nature causing concern, many market participants had speculated that North Korea, in celebration of their 69th anniversary, would launch another missile this past weekend. Fortunately, this did not occur. The market’s slight decline last week, in part due to this concern, underscores the vulnerability of equities to a potential crisis on the Korean peninsula, namely, the disruption in economic activity that the geopolitical event would likely cause. When forecasting, it is critical to consider the probability of an event and not to let recency bias skew reality. The bombardment of media headlines may cause some to believe that a war with North Korea is probably a foregone conclusion. Given the facts as they stand, however, we do not believe actionable escalation will occur and are not adjusting our market outlook at this time.

On a lighter note, the NFL season kicked off this past weekend to the delight of millions. One term coaches preach to football players of all ages is to “keep your head on a swivel.” In other words, don’t let anyone sneak up and blind side you. We believe this advice is also applicable to investing. While investors should not overreact to every headline that scrolls across their screen, they should always be looking out for developing events that may derail the economy and negatively impact stock markets.

Important Information and Disclaimers

Disclosures: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITSs that primarily own and operate income-producing real estate.