Stocks Rally on Rate Cut Hopes and AI Momentum

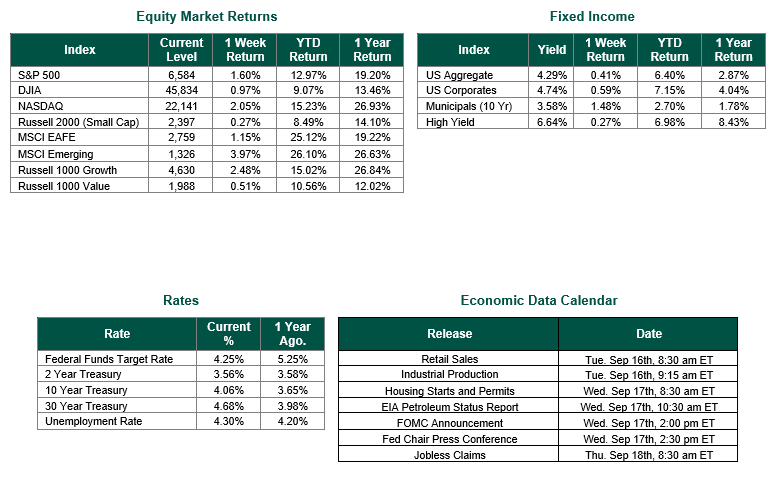

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,584, representing a gain of 1.60%, while the Russell Midcap Index moved 0.36% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.27% over the week. As developed, international equity performance and emerging markets were positive, returning 1.15% and 3.97%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.29%.

As we head into the Federal Reserve’s September 2025 policy meeting, U.S. stock markets closed the week higher, fueled by expectations of lower interest rates ahead (perhaps as many as three rate cuts of 0.25% each over the final three FOMC meetings of 2025) and excitement over artificial intelligence (AI) advancements. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite Index all touched new highs, driven by optimism surrounding the Fed’s anticipated rate cuts and Oracle’s robust AI-driven guidance, which highlighted major new AI deals. The Russell 2000 also continued its strong performance, marking six consecutive weeks of gains. However, the Dow and S&P 500 saw slight pullbacks in a quiet Friday session at the end of the week, reflecting cautious positioning ahead of the Fed’s decision this week.

August inflation data, which was reported last week, showed a mixed picture. The Consumer Price Index (CPI) rose 2.9% year-over-year, up from July’s 2.7%, while core CPI, excluding food and energy, hit 3.1%. Meanwhile, the Producer Price Index (PPI) slowed to 2.6% from 3.1%, though core PPI edged up to 2.8%. Despite inflation remaining above the Fed’s 2% target, a softening labor market—highlighted by 263,000 initial jobless claims (the highest since October 2021) and revised BLS data showing that 911,000 fewer jobs were created over the last twelve months than initially reported more than likely keeps rate cuts on the table.

The University of Michigan’s Consumer Sentiment Index fell to 55.4 in September from 58.2 in August, reflecting growing concerns about business conditions, labor markets, and inflation. Short-term inflation expectations stayed at 4.8%, while long-term expectations rose to 3.9%.

U.S. Treasuries posted gains, with long-term yields dipping and short-term yields holding steady. Strong demand at recent Treasury auctions signals sustained investor confidence in U.S. debt. Investment-grade corporate bonds outperformed Treasuries, and high yield bonds advanced as rate cut expectations grew.

The combination of potential rate cuts, modestly persistent inflation, and AI-driven market enthusiasm creates a dynamic landscape. As the Fed’s decision looms, it is becoming increasingly important to work with financial professionals to ensure that your portfolio is positioned effectively based on your personal goals, objectives, and risk tolerances.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 9/12/25. CPI and PPI from the Bureau of Labor Statistics on 9/11/25. Jobless claims sourced from the U.S. Labor Department on 9/11/25. Consumer Sentiment from the University of Michigan on 9/12/25. Economic Calendar Data from Econoday as of 9/15/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.