Stocks Retreat Amid Tech Weakness

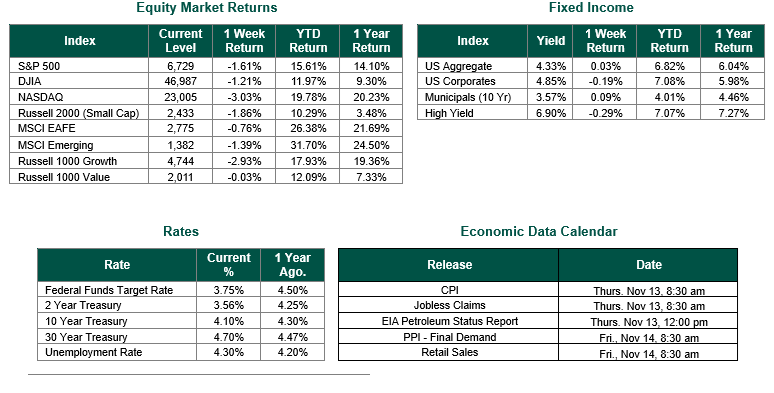

Global equity markets finished down for the week. In the U.S., the S&P 500 Index closed the week at a level of 6729, representing a loss of 1.61%, while the Russell Midcap Index moved -0.17% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -1.86% over the week. As developed international equity performance and emerging markets were negative, returning -0.76% and -1.39%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.10%.

U.S. stocks finished the week lower, ending a three-week winning streak as investors reassessed valuations in major technology names and reacted to mixed economic signals. The Nasdaq Composite led the pullback, while the Russell 1000 Growth Index lagged its value counterpart by nearly three percentage points—its widest gap since February. Market sentiment was also influenced by the now-resolved federal government shutdown, which reached a record duration before lawmakers struck a bipartisan Senate deal over the weekend to reopen the government. The agreement is expected to restore normal operations in the coming days, easing some of the uncertainty that has weighed on both federal employees and financial markets.

With limited government data available during the shutdown, investors turned to private reports for direction. ADP data showed that private employers added 42,000 jobs in October, a modest rebound after two months of declines, though hiring remained uneven across industries. Challenger, Gray & Christmas reported nearly 1.1 million announced job cuts through October—up 65% from last year and the highest total for the month since 2003.

Economic data painted a mixed picture. The Institute for Supply Management’s Services PMI rose to 52.4% in October, pointing to renewed growth in the services sector, while the Manufacturing PMI slipped to 48.7%, marking its eighth consecutive month of contraction. Consumer confidence fell sharply, with the University of Michigan’s sentiment index dropping to 50.3—its lowest level since mid-2022—amid concerns over the shutdown’s impact and persistent inflation pressures.

In fixed income, U.S. Treasuries posted modest gains as shorter-term yields declined and longer-term yields edged higher. Municipal bonds performed similarly, supported by solid cash inflows and steady secondary trading activity. High-yield bonds underperformed as investors turned more cautious in the wake of the equity sell-off.

Looking ahead, attention will shift to the reopening of government agencies and the return of key economic data releases, which should offer a clearer view of U.S. growth trends heading into year-end. Investors will also be monitoring inflation updates and corporate earnings—especially from leading technology and AI-focused firms—for insight into whether recent market softness signals a temporary pause or a broader shift in momentum. Overall, while volatility may persist in the short term, the government’s reopening and continued economic resilience could help restore confidence as the year closes.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 11/7/25. ADP Payrolls and CC&G Payrolls sourced directly on 11/6/25 and 11/7/25, respectively. Manufacturing PMI sourced from the ISM on 11/5/25. Consumer sentiment sourced from the University of Michigan on 11/8/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.