Strong Economic Growth with Inflation Remaining Above Target

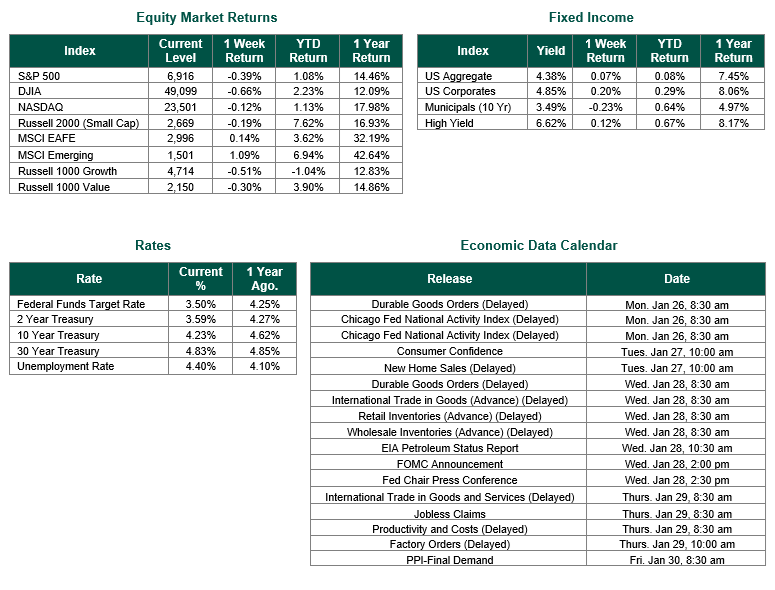

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed the week at a level of 6916, representing a decrease of 0.39%, while the Russell Midcap Index moved +0.45% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.19% over the week. As developed international equity performance and emerging markets were positive, returning 0.14% and 1.09%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.23%.

The economic data released last week painted a picture of an economy growing briskly but still wrestling with persistent, though contained, inflation pressures.

The updated estimate for third-quarter 2025 GDP showed real output expanding at a 4.4% annualized pace, a slight upward revision from the prior 4.3% reading and the fastest growth since late 2023, driven by solid consumer spending, firmer business investment, and some support from exports.

Alongside that growth, the Personal Consumption Expenditures (PCE) Price index—the Federal Reserve’s preferred inflation gauge—rose at a 2.8% annual rate in the third quarter. At the same time, core PCE, which strips out volatile food and energy prices, increased 2.9%, underscoring that inflation has eased from its peak but is still running above the Fed’s 2% target. Monthly readings into November showed headline and core PCE both advancing 0.2% on the month and roughly 2.8% over the prior year, reinforcing the narrative of moderate but sticky price pressures rather than a decisive return to target.

Labor market data were consistent with that “not too hot, not too cold Goldilocks” backdrop. For example, weekly jobless claims held near 200,000, a level that signals very low layoffs but also reflects what economists have described as a “low‑hiring, low‑firing” labor market in which firms are cautious about adding workers yet reluctant to shed them.

Forward-looking indicators and sentiment were more mixed; purchasing managers’ surveys of the composite PMI suggested growth continuing at a modest clip rather than accelerating sharply, while consumer sentiment remained subdued relative to pre-pandemic norms, reflecting ongoing concerns about the cost of living, even as wage gains and continued spending by higher-income households supported overall demand.

Corporations continued to report earnings for the fourth quarter last week. According to FactSet, the fourth-quarter earnings season was still in its early stages, with roughly 13% of S&P 500 companies reporting results and about three-quarters beating consensus EPS estimates. At the same time, 69% of reporting companies delivered positive revenue surprises. The blended year-over-year earnings growth rate for Q4 2025, which combines reported results with estimates for companies yet to report, stood at approximately 8.2%—a solid pace that, if realized, would mark the tenth consecutive quarter of earnings expansion. Sector-level performance has been uneven thus far, with financials and parts of the consumer discretionary sector showing some of the strongest upside surprises. In contrast, health care, utilities, and energy companies lagged as downward revisions and softer results weighed on their contribution to index‑level growth.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 1/23/26. GDP and PCE data were sourced from the Bureau of Economic Analysis. Weekly Jobless Claims were sourced from the U.S. Department of Labor. PMI data was sourced from S&P Global. Consumer Sentiment data was sourced from the University of Michigan. Fourth quarter earnings data was sourced for Fact Set. Calendar Data from Econoday as of 1/23/26. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.