The Fed Maintains Stance amidst Consistent Economic Data

Market Overview

Happening Now

The Federal Open Market Committee (FOMC), as expected, announced Wednesday they would maintain the target fed funds rate at the current level of 0.0 – 0.25%, marking the 55th consecutive meeting without a change in borrowing costs. The consensus view among Wall Street strategists as to when the FOMC will actually lifts rates appears wide spread with many “best guesses” suggesting there is a 50/50 chance of a rate lift in September while some prominent asset managers, such as Jeffrey Gundlach, believe the Fed will not move until 2016.

The Fed cited “moderate” growth in the U.S. economy last Wednesday, the same language used in their June statement, as well as the need for further improvement in the employment situation, before conditions will warrant a rate increase. It appears, based on last week’s GDP and jobless claims numbers that conditions are moving in that direction. While U.S. GDP grew at an annual rate of only 2.3% over the course of Q2 versus the Econoday consensus of 2.9%, the Q1 reading was revised upward from a negative 0.2% to a positive 0.6%, suggesting less volatility in our nation’s economic output. In terms of the employment situation, jobless claims came in below the consensus estimate yet again (a positive in this context) with a reading of 267,000 for the week ended July 25, lowering the 4 week moving average to 274,750. All eyes will now be on this week’s monthly employment situation report from the Bureau of Labor Statistics due Friday for additional insight.

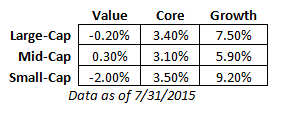

We at SmartTrust continue to believe that the pace of rate increases and terminal level the target rate ultimately reaches will play a greater role in asset pricing going forward than the actual timing of the initial rate hike. With this being said, it is insightful to analyze the returns of growth stocks versus value stocks as investors anticipate a rising rate environment:

Consistent with historical periods of rising interest rates, value stocks, which tend to pay higher dividends than growth stocks while offering lower relative valuations in exchange for less momentum and lower growth in sales and profitability, have underperformed so far in 2015 by an average of over 8%. The question becomes whether this pace of outperformance is sustainable and likely to continue, or if market participants are in store for a reversal. We believe that focusing on longer term investment themes while remaining agile enough to navigate short term volatility is the key to success in this macro- economic driven market.

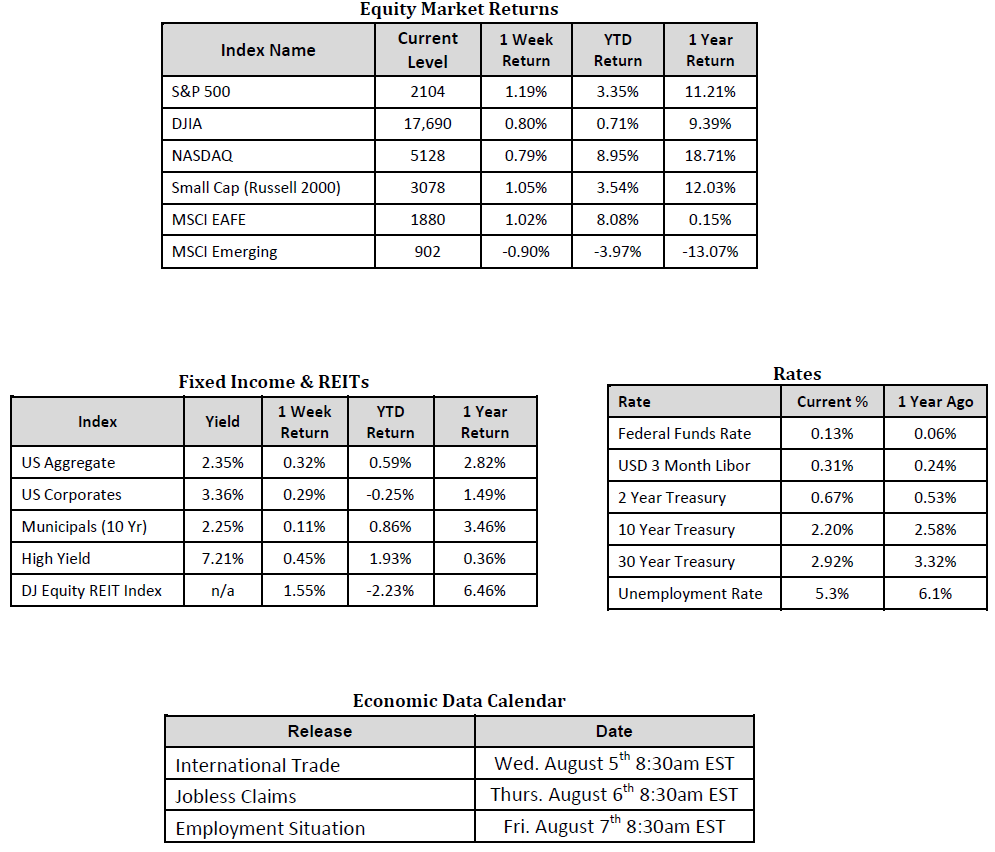

Sources: Equity Market, Fixed Income and REIT returns from JP Morgan as of 7/31/15. Rates and Economic Calendar Data from Bloomberg as of 8/03/15.

Important Information and Disclaimers

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITSs that primarily own and operate income-producing real estate