The First Golden Week (Five New All-time Highs) Since November of ‘21

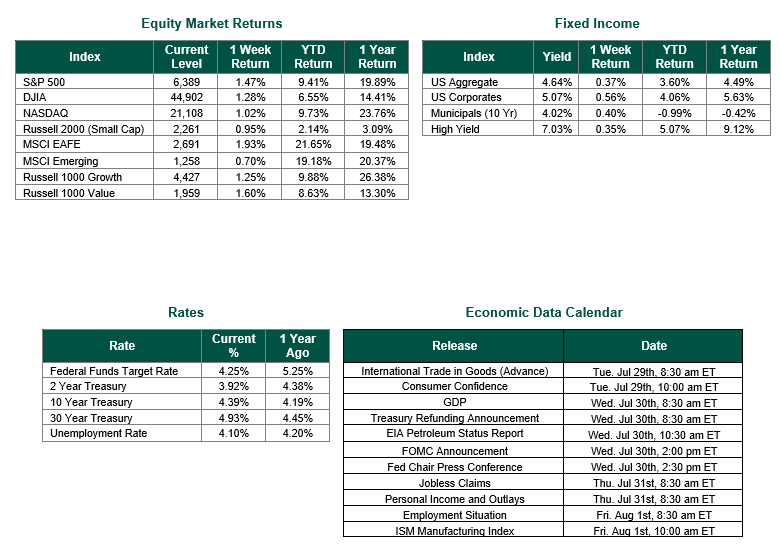

Global equity markets finished higher for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,389, representing a weekly gain of 1.47%, while the Russell Midcap Index moved 1.25% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 0.95% over the week. As developed, international equity performance and emerging markets were positive, returning 1.93% and 0.70%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.39%.

As reported by FactSet, the second-quarter earnings season for S&P 500 companies is off to a solid start, showing promising signs across key financial metrics. Earnings growth is tracking at a blended year-over-year rate of 5.6%, slightly surpassing the earlier forecast of 4.9%. Revenue growth remains robust at 4.4%, marking the 19th consecutive quarter of year-over-year revenue increases. Corporate performance has exceeded expectations, with 83% of companies reporting earnings per share (EPS) above analyst estimates—well ahead of the five-year average of 78%. Similarly, 83% have outpaced revenue projections, outperforming the five-year average of 70%.

Among the standout sectors, Financials have posted strong results, with leading banks like JPMorgan, Goldman Sachs, and Citigroup driving much of the positive momentum. The technology sector, led by the so-called “Magnificent 7” is expected to deliver an impressive 14.1% earnings growth, a notable contrast to the 3.4% anticipated for the rest of the index.

Last week also saw a surge of activity surrounding U.S. trade tariffs, reshaping international commerce and diplomatic dynamics. The Administration announced a sweeping revision to the U.S. tariff structure, introducing a new baseline range of 15% to 50% on imports—replacing the previous uniform rate of 10%. A deal with Japan set a 15% tariff on Japanese imports, while Japan committed to investing $550 billion in the United States, though disagreements over profit-sharing terms have yet to be resolved. Meanwhile, the U.S. reached separate agreements with Indonesia and the Philippines to implement 19% import tariffs, with the notable exception that American exports to both countries will remain tariff-free. Malaysia remains in negotiations to lower its proposed tariff rate to 20%, though reports suggest the discussions are tense and outcomes are uncertain.

Over the Weekend, the United States and the United Kingdom unveiled a new trade agreement that builds on their longstanding economic partnership. The deal introduces a tiered tariff structure, with most UK exports to the U.S. now subject to rates between 15% and 30%, replacing the previous flat 10% rate.

Markets have responded enthusiastically to both corporate earnings and Trade developments. The S&P 500 and Nasdaq reached record highs during the week. However, the Dow lagged behind, weighed down by underwhelming reports from IBM and Tesla. Looking ahead, full-year earnings growth for 2025 is projected at 9.3%, with acceleration expected in 2026 to 14.0%. Investors remain watchful of corporate guidance as global trade tensions and tariff uncertainties loom, especially with new tariffs slated to take effect on August 1.

Best wishes for the Week ahead.

Equity and Fixed Income Index returns sourced from Bloomberg on 7/25/25. Corporate Earnings Data sourced from FactSet. Economic Calendar Data from Econoday as of 7/25/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.