The Good Times Roll Again for Another Week

Market Overview

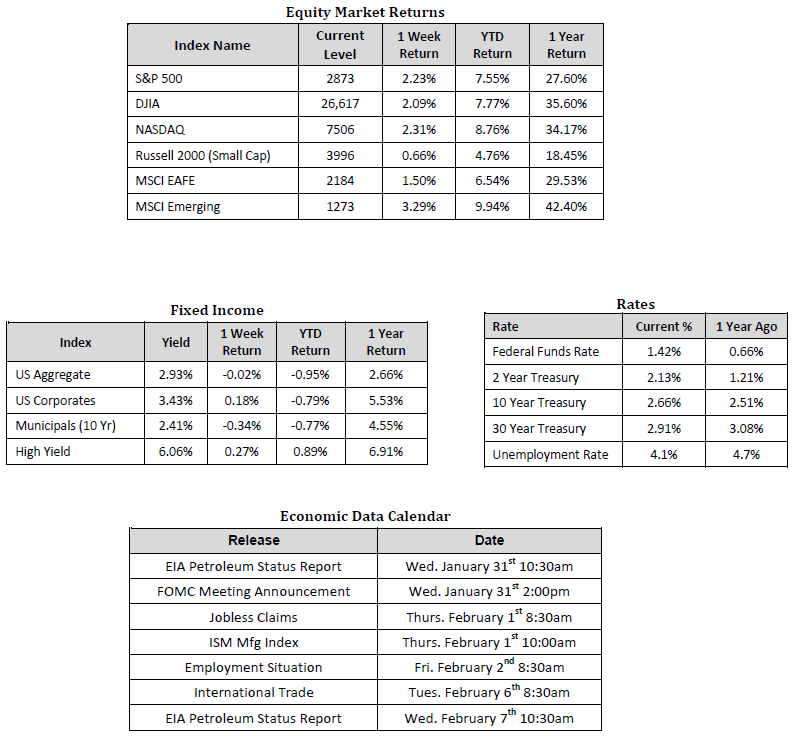

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 01/29/18. Rates and Economic Calendar Data from Bloomberg as of 01/29/18. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

U.S. Stocks experienced yet another week of substantial gains as the dollar continued to fall and interest rates rose. The S&P 500 Index gained 2.2% outpacing gains in the Russell Midcap Index which advanced 1.6%, and the Russell 2000 Index which gained 0.7%. This is the fourth consecutive week of gains in large cap U.S. stocks, and the third weekly advance of over 1.0% so far this year. To put this recent strength in context, consider that over the past 12 months there have been a total of three weeks during which the market fell by over 1.0%. Internationally, developed markets gained 1.5% and emerging markets gained 3.3%. In terms of year-to-date performance, emerging markets lead their developed counterparts with a gain of 9.9%, U.S. equities follow with a 7.6% gain, and developed international markets lag with a still impressive 6.5% gain.

This year’s red hot start is a function of accommodative financial conditions meeting tax reform, global economic growth, earnings growth, and the potential for fiscal stimulus. Low inflation and the associated low interest rates not only support a healthy global economic expansion but also influence risk taking by investors. With little return offered in government bonds at present, investors are met with the dilemma of whether to sit on the sidelines until rates rise, or to dip their toes into the waters of the equity markets. This new demand for stocks, from investors that may normally invest in fixed income, further supports stock prices. We believe, in the near term, there is unlikely to be a recession or a prolonged bear market and look through relatively high valuations to remain comfortably invested in a diversified portfolio including stocks.

While we are optimistic on the outlook for stocks, we believe that today’s low level of volatility is unlikely to persist. The market has been resilient in the face of headlines recently but the risk of an event driven sell-off, sparked by geopolitical events for example, remains and high valuations can increase the severity of such a pullback. Until the economy slows, earnings disappoint, and/or actual inflation readings exceed expectations, any market pullbacks can be seen as potential buying opportunities for long term investors.

Important Information and Disclaimers

Disclosures: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.