The World Economic Forum: Implications Beyond Climate Change

Market Overview

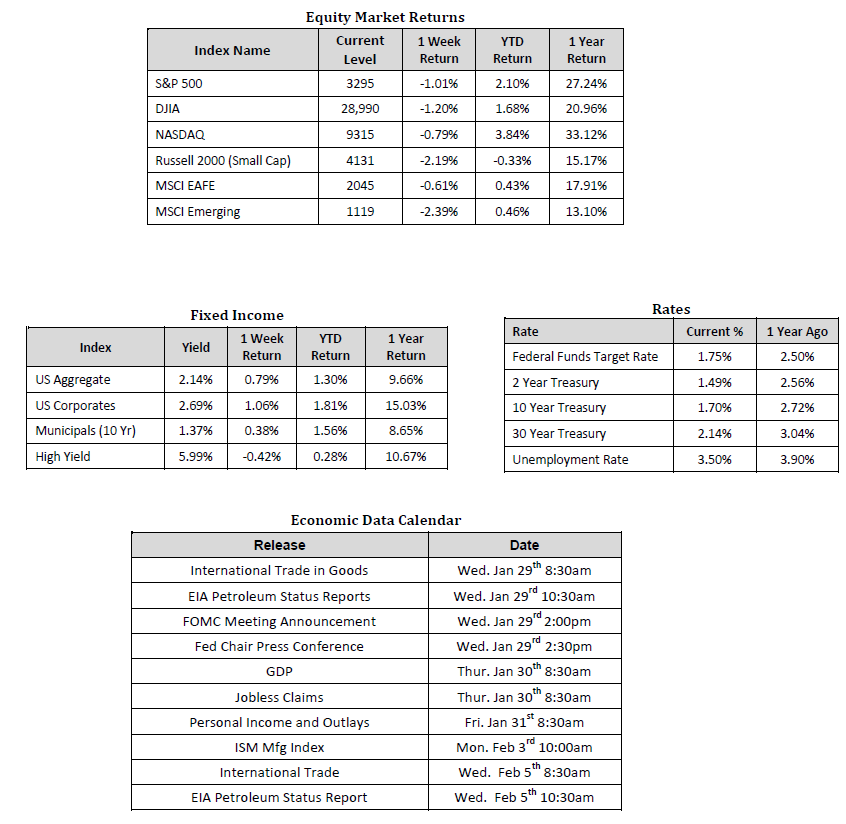

Sources: Sources for data in tables: Equity Market and Fixed Income returns are from JP Morgan as of 1/24/2020. Rates and Economic Calendar Data from Bloomberg as of 1/24/2020. International developed markets measured by the MSCI EAFE Index, emerging markets measured by the MSCI EM Index. Sector performance is measured using GICS methodology.

Happening Now

Equities retreated across the board last week as investors weighed the potential impacts of the outbreak of the coronavirus in China. In the U.S., the S&P 500 Index fell to a level of 3,295, representing a loss of 1.01%, while the Russell Midcap Index gave back 1.07%. The Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -2.19% over the week. In the U.S., the impact could have been worse if it weren’t for generally positive earnings results and economic data releases. On the international equities front, developed markets also finished in the red, returning -0.61%, while emerging markets were hit the hardest with a weekly loss of 2.39%. This should not come as too much of a surprise seeing that the coronavirus originated and is currently concentrated in China. Finally, the 10-year U.S. Treasury yield dropped to 1.70% amid the “risk-off” sentiment.

The World Economic Forum (WEF), an annual meeting featuring world leaders in business and politics, concluded last week in the Swiss city of Davos. Globalization, technology, and creating a better world are generally common themes at the event. However, this year’s theme, “Stakeholders for a Cohesive and Sustainable World,” draws upon a very important concept; stakeholders vs. shareholders. The theme especially relates to businesses and is reflected in this excerpt from the WEF’s website:

“Since the first Industrial Revolution, businesses have been on the frontline of technological and social change. There’s no way we’ll create a cohesive, resilient world without them. But to do this we’ll need them to shift their time horizons, look beyond short term profits, and transform themselves into sustainable and inclusive organisations. What’s a smart company to do?”

A company’s reach often impacts far more than shareholders, who typically benefit from activity leading to tangible gains such as stock price appreciation, share buybacks, and/or dividends. The argument is that companies need to look through a broader lense and expand their horizon from short-term profits to longer-term impact, which includes how operations affect all stakeholders. Headlines from the forum seemed to focus on climate change, but that’s only one aspect of the entire stakeholder picture. Others may include a company’s workers, customers, communities, the environment, AND shareholders. It’s this comprehensive view of a company that may lead to a more sustainable economic environment that benefits all stakeholders and society as a whole.

With that said, it appears the right conversations are taking place worldwide as financial assets are flowing into funds that take into account a company’s Environmental, Social, and Governance (ESG) ratings and firms are responding (see Microsoft’s “carbon negative by 2030” pledge). There are also a growing number of companies and organizations conducting research dedicated to placing a value on companies to help promote better business practices. One such company is JUST Capital who measures and ranks company performance on topics Americans care about most, as determined through their proprietary polling process. In fact, JUST attended the forum in Davos and published their “5 Takeaways on the Future of Stakeholder Capitalism” which may provide some insight into topics discussed. These include:

• Stakeholder capitalism is the systems reboot we need

• We need less talk, more action

• We need to simplify – and agree on – how we measure stakeholder performance

• Stakeholder capitalism will make companies more resilient to downside risks

• Stakeholder value versus shareholder value is a false choice

We encourage investors to educate themselves on how this growing trend may impact their portfolios and, as always, work with experienced financial professionals to help manage their portfolios through various market cycles within a well-diversified framework that is consistent with their objectives, time-frame and tolerance for risk.

Disclosure: Hennion & Walsh Asset Management currently has allocations within its managed money program and Hennion & Walsh currently has allocations within certain SmartTrust® Unit Investment Trusts (UITs) consistent with several of the portfolio management ideas for consideration cited above.

Important Information and Disclaimers

Disclosures: Hennion & Walsh is the sponsor of SmartTrust® Unit Investment Trusts (UITs). For more information on SmartTrust® UITs, please visit www.smarttrustuit.com. The overview above is for informational purposes and is not an offer to sell or a solicitation of an offer to buy any SmartTrust® UITs. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust and investors should read the prospectus carefully before they invest.

Investing in foreign securities presents certain risks not associated with domestic investments, such as currency fluctuation, political and economic instability, and different accounting standards. This may result in greater share price volatility. These risks are heightened in emerging markets.

There are special risks associated with an investment in real estate, including credit risk, interest rate fluctuations and the impact of varied economic conditions. Distributions from REIT investments are taxed at the owner’s tax bracket.

The prices of small company and mid cap stocks are generally more volatile than large company stocks. They often involve higher risks because smaller companies may lack the management expertise, financial resources, product diversification and competitive strengths to endure adverse economic conditions.

Investing in commodities is not suitable for all investors. Exposure to the commodities markets may subject an investment to greater share price volatility than an investment in traditional equity or debt securities. Investments in commodities may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity.

Products that invest in commodities may employ more complex strategies which may expose investors to additional risks.

Investing in fixed income securities involves certain risks such as market risk if sold prior to maturity and credit risk especially if investing in high yield bonds, which have lower ratings and are subject to greater volatility. All fixed income investments may be worth less than original cost upon redemption or maturity. Bond Prices fluctuate inversely to changes in interest rates. Therefore, a general rise in interest rates can result in the decline of the value of your investment.

Definitions

MSCI- EAFE: The Morgan Stanley Capital International Europe, Australasia and Far East Index, a free float-adjusted market capitalization index that is designed to measure developed-market equity performance, excluding the United States and Canada.

MSCI-Emerging Markets: The Morgan Stanley Capital International Emerging Market Index, is a free float-adjusted market capitalization index that is designed to measure the performance of global emerging markets of about 25 emerging economies.

Russell 3000: The Russell 3000 measures the performance of the 3000 largest US companies based on total market capitalization and represents about 98% of the investible US Equity market.

ML BOFA US Corp Mstr [Merill Lynch US Corporate Master]: The Merrill Lynch Corporate Master Market Index is a statistical composite tracking the performance of the entire US corporate bond market over time.

ML Muni Master [Merill Lynch US Corporate Master]: The Merrill Lynch Municipal Bond Master Index is a broad measure of the municipal fixed income market.

Investors cannot directly purchase any index.

LIBOR, London Interbank Offered Rate, is the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London.

The Dow Jones Industrial Average is an unweighted index of 30 “blue-chip” industrial U.S. stocks.

The S&P Midcap 400 Index is a capitalization-weighted index measuring the performance of the mid-range sector of the U.S. stock market, and represents approximately 7% of the total market value of U.S. equities. Companies in the Index fall between S&P 500 Index and the S&P SmallCap 600 Index in size: between $1-4 billion.

DJ Equity REIT Index represents all publicly traded real estate investment trusts in the Dow Jones U.S. stock universe classified as Equity REITs according to the S&P Dow Jones Indices REIT Industry Classification Hierarchy. These companies are REITs that primarily own and operate income-producing real estate.