Trade Progress & Consumer Sentiment Shape Markets

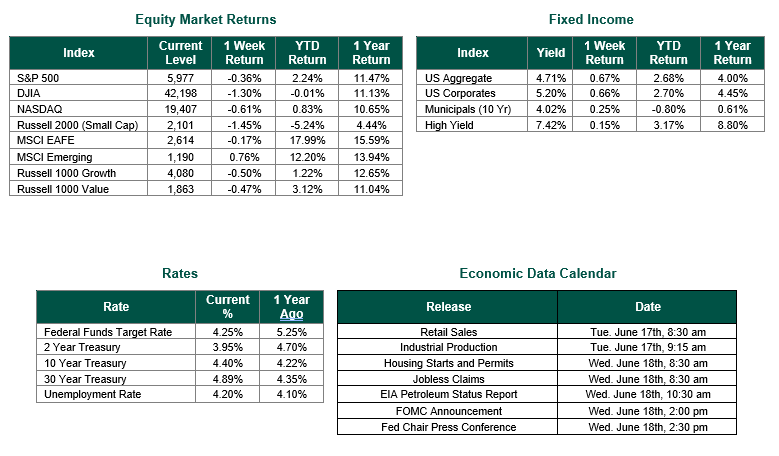

Global equity markets finished lower for the week. In the U.S., the S&P 500 Index closed at 5,977, representing a decline of 0.36%, while the Russell Midcap Index fell 1.30% to end the week at 3,557.76. Meanwhile, the Russell 2000 Index, a measure of the nation’s smallest publicly traded firms, declined 1.45% for the week. Developed international equity performance (MSCI EAFE) and emerging markets (MSCI Emerging) were mixed, returning –0.17% and +0.76%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.40%.

Early in the week, markets rose as investors reacted positively to news of U.S.-China trade talks in London, which culminated in a preliminary framework for a longer-term trade agreement, extending a temporary tariff reprieve agreed upon in May. This progress eased concerns about immediate tariff-driven disruptions, boosting risk-on sentiment. However, sentiment shifted sharply on Friday as geopolitical tensions flared, with Israel launching airstrikes on Iran’s nuclear and military facilities, prompting a retaliatory missile attack from Iran. This escalation sent oil prices surging and triggered a broad market sell-off, with energy sectors gaining while most others declined. The week’s volatility underscored the market’s sensitivity to both trade policy developments and geopolitical risks.

Economic data releases painted a mostly positive picture, with trade and inflation dynamics taking center stage. The U.S. trade deficit narrowed significantly in April, dropping from $138.3 billion in March to $61.6 billion, as imports fell 19.8%—the largest monthly decline on record—while exports rose. The Consumer Price Index (CPI) increased 0.1% month-over-month in May, with the annual rate ticking up to 2.4% from 2.3%, though economists noted that underlying inflation trends remained close to the Federal Reserve’s 2% target. Consumer sentiment also showed improvement, with the University of Michigan’s preliminary June Index of Consumer Sentiment rising to 60.5 from 52.2 in May, likely driven by easing trade tensions.

Investors are now focused on upcoming data, including global PMI surveys, the U.S. employment report, and further clarity on trade agreements. Geopolitical developments, particularly in the Middle East, and their impact on oil prices will likely continue to influence market sentiment. The Federal Reserve’s next moves remain critical, with tariff-driven inflation risks potentially delaying anticipated rate cuts. We do not anticipate any interest rate actions from the Federal Reserve this week, but look forward to analyzing their updated “Dot Plot” chart and Summary of Economic Projections.

Best wishes for the week ahead, and Happy Father’s Day to all!

Equity and Fixed Income Index returns sourced from Bloomberg on 6/13/25. U.S Trade Data sourced from the Bureau of Economic Analysis on 6/12/25. CPI Data sourced from the Bureau of Labor Statistics on 6/11/25. Consumer Sentiment Data sourced from the University of Michigan Surveys of Consumers on 6/13/25. Economic Calendar Data from Econoday as of 6/16/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.