U.S. Treasury Yields Steepen as Fed Cuts Rates Again

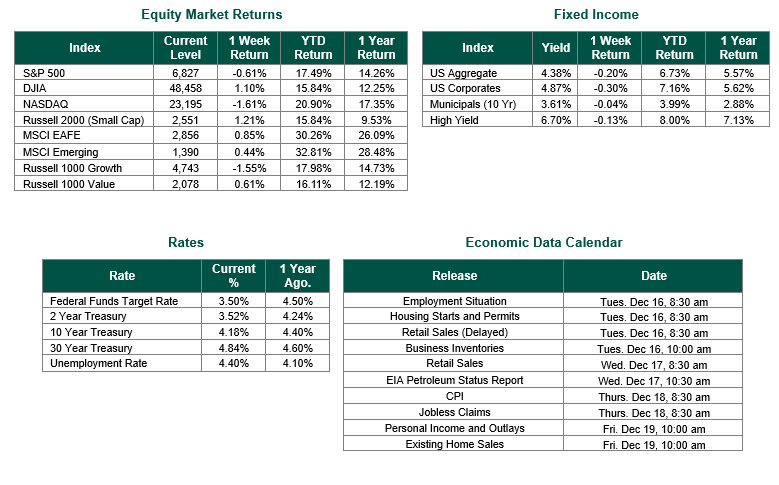

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6827, representing a decrease of 0.61%, while the Russell Midcap Index moved +0.98% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned 1.21% over the week. As developed international equity performance and emerging markets were positive, returning 0.85% and 0.44%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.18%.

The Federal Open Market Committee (FOMC) concluded its final meeting of 2025 last week, announcing a widely anticipated 25-basis-point (0.25%) reduction in the target range for the federal funds rate, bringing it to 3.50%–3.75%. This action marked the third consecutive cut of this magnitude. The decision was approved in a divided vote, with three policymakers dissenting—the first such occurrence in several years—reflecting differing views on the appropriate pace of easing. The policy statement incorporated language emphasizing careful assessment of incoming data, which has historically signaled potential pauses in rate adjustments.

Federal Reserve Chair Jerome Powell’s remarks during the post-meeting press conference conveyed a balanced perspective, noting that the current policy rate is within estimates of neutral levels while acknowledging risks to the labor market. The Committee also indicated it would initiate purchases of shorter-term Treasury securities as necessary to maintain ample reserves. Perhaps most importantly, the Federal Reserve’s new “Dot Plot” chart indicated just one additional 25 Bp cut in 2026 and one more 25 Bp cut in 2027, which, when combined, would bring the Fed Funds Target Rate to its stated neutral rate of 3%

Labor market data presented a nuanced picture last week. Initial claims for unemployment benefits rose sharply to 236,000, an increase of 44,000 from the prior week and the highest level in several months. Conversely, continuing claims declined to 1.838 million, the lowest since mid-2025. Additionally, the October Job Openings and Labor Turnover Survey (JOLTS) reported 7.670 million job openings, a slight increase and the highest level in five months. Hires decreased modestly, while the quits rate reached its lowest level since 2020, suggesting reduced worker confidence in job mobility.

U.S. Treasury yields displayed divergence across maturities. Shorter-term yields generally declined following the Federal Reserve’s announcements described above, while longer-term yields ended the week slightly higher. For example, the 2-year treasury bond fell 11 basis points to 3.52% to end the week, while the 30-year treasury bond moved two basis points higher to 4.83%.

This environment reflects ongoing transitions in monetary policy and sector rotations within equities. We will closely monitor these developments and continue to recommend that investors strive to maintain diversified portfolios that align with their individual risk tolerances, investment timeframes, and long-term objectives.

Best wishes for the week ahead!

Equity and Fixed Income Index returns sourced from Bloomberg on 12/12/25. Jobless Claims sourced from the US Department of Labor on 12/11/25. JOLTS data sourced from the Bureau of Labor Statistics on 12/9/25. Calendar Data from Econoday as of 12/15/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.