Weaker Employment Data Increases Probability of a Rate Cut

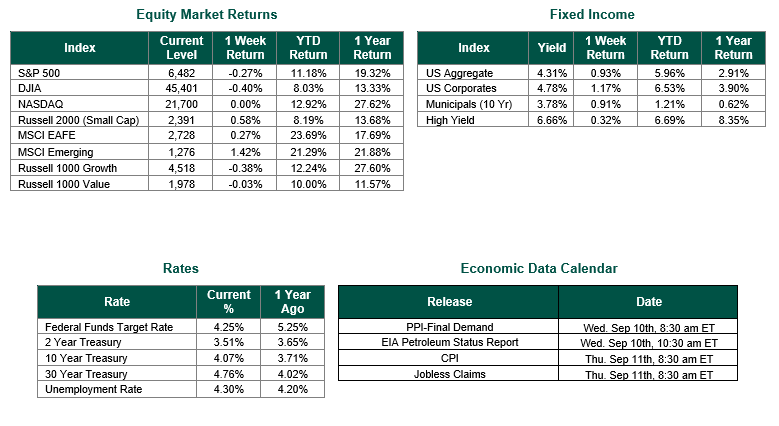

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6,482, representing a decline of -0.27%, while the Russell Midcap Index moved +0.19% last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned +0.58% over the week. As developed, international equity performance and emerging markets were positive, returning to +0.27% and +1.42%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.07%. Last week, U.S. economic data releases painted a mixed picture of the labor market and manufacturing sector, offering important insights for policymakers and investors.

Key labor indicators, including the JOLTS report, ADP Employment Report, weekly jobless claims, and the official Employment Situation, were closely watched. The JOLTS survey, typically released early in the week, provided context on job openings and labor turnover; market sentiment suggested stability in the number of job openings, but underlying softness persisted. The ADP Employment Report later indicated modest private sector job growth, with hiring concentrated in technology and services and manufacturing jobs remaining muted. Weekly jobless claims remained steady, reflecting few signs of major layoffs but still pointing to a labor market that has cooled compared to the prior year. The Employment Situation report from the Bureau of Labor Statistics showed the unemployment rate was largely unchanged at 4.3%, with 7.4 million people unemployed evidence that the labor market is resilient yet not tightening further.

The employment data released last week, which showed continued labor market softening with stagnant job creation and a slightly elevated unemployment rate, had a significant impact on expectations for the Federal Open Market Committee’s (FOMC) upcoming rate decision. Fed officials, including Christopher Waller, publicly supported the prospect of a rate cut in September to prevent further deterioration in labor conditions and forestall a possible rise in unemployment.

Market analysts reacted swiftly to the weaker jobs data, leading Treasury yields to fall and increasing the probability of a September rate reduction to nearly 75%, with some forecasters expecting a string of cuts in the coming months. While inflation concerns linger due to ongoing tariff impacts, the labor market’s lack of momentum prompted the Fed to prioritize employment stability over restrictive policy, making a near-term rate cut highly likely as the central bank aims to rebalance growth and price stability. As a result, the softened employment data decisively tipped the balance toward rate relief, illustrating the Fed’s heightened sensitivity to labor market signals ahead of its September meeting.

The ISM Manufacturing PMI for August, released on September 2, showed continued contraction at 48.7%, up just 0.7 points from July, marking the sixth straight month of shrinking activity. However, new orders rebounded to expansion territory at 51.4%, hinting at possible stabilization. Production and employment indices both remained in contraction, underscoring ongoing challenges for factory operators, especially those exposed to tariffs and input cost inflation. The prices index stayed elevated, reflecting persistent inflationary pressures in manufacturing inputs such as raw materials. Industry comments highlighted particular resilience in tech-driven segments like electronics, but traditional sectors like apparel and machinery continued to struggle.

Looking ahead, the latest economic indicators have sharpened the focus on the Federal Reserve’s next moves as markets anticipate a highly probable rate cut at the September FOMC meeting. With the labor market showing subtle signs of strain and manufacturing still in contraction, the Fed faces increasing pressure to provide policy support without igniting inflation. As analysts and investors position portfolios for lower yields and more credit-friendly conditions, the prospect of a reduction in benchmark rates—estimated at an 85-95% chance—highlights the central bank’s commitment to respond to evolving risks and maintain economic balance. While much depends on additional data in the run-up to the meeting, last week’s developments have placed monetary policy at the heart of the outlook, setting the stage for critical decisions that could shape growth, investment, and consumer sentiment in the months ahead.

Best wishes for the Week ahead.

Equity and Fixed Income Index returns sourced from Bloomberg on 9/5/25. The JOLTS report, weekly jobless claims and the Employment Situation were sourced from the Bureau of Labor Statistics. ISM Manufacturing PMI data was sourced from the Institute for Supply Management. Economic Calendar Data from Econoday as of 9/5/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio but does not ensure a profit or guarantee against a loss.