Will Cooler Inflation Report Lead to a Santa Claus Rally?

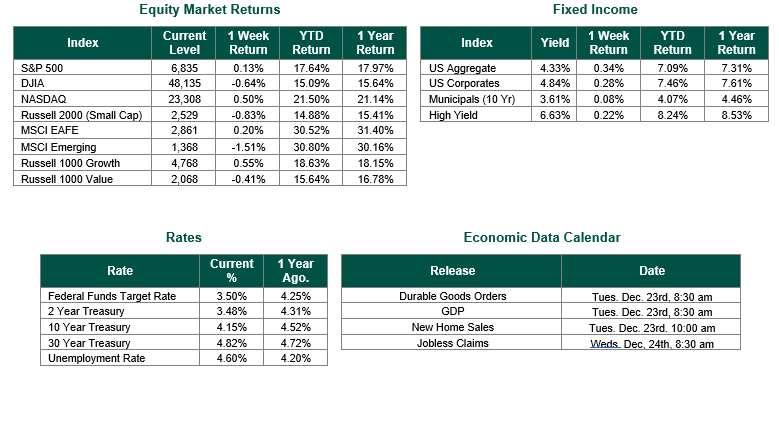

Global equity markets finished mixed for the week. In the U.S., the S&P 500 Index closed the week at a level of 6835, representing an increase of 0.13%, while the Russell Midcap Index moved 0.13% lower last week. Meanwhile, the Russell 2000 Index, a measure of the Nation’s smallest publicly traded firms, returned -0.83% over the week. As developed international equity performance and emerging markets were also mixed, returning 0.20% and -1.51%, respectively. Finally, the 10-year U.S. Treasury yield moved higher, closing the week at 4.15%.

U.S. equity markets exhibited volatility during the week, with major indexes initially declining amid persistent concerns over valuations in the technology sector and spending on artificial intelligence. However, sentiment improved later in the week, driven by stronger-than-expected earnings from semiconductor firm Micron Technology and a favorable inflation report.

The Bureau of Labor Statistics (BLS) released the November Employment Situation report on December 16, 2025. Nonfarm payrolls increased by 64,000 jobs, surpassing consensus estimates of approximately 45,000 and marking a rebound from the revised October decline of 105,000 (largely due to federal government job losses of 162,000 amid the prior shutdown). Gains were primarily in health care (+46,000) and construction (+28,000). The unemployment rate rose to 4.6%, the highest in over four years. These figures, while distorted by the federal government shutdown’s impact on data collection, suggest a stabilizing yet softening labor market.

The BLS also issued the November Consumer Price Index (CPI) on December 18, showing CPI rose 2.7% year-over-year, below expectations of around 3.1% and down from September’s 3.0% (the October data release was skipped due to shutdown-related issues). Core CPI (excluding food and energy) increased 2.6% year-over-year, the slowest pace since March 2021, and shelter inflation moderated to 3.0%, the lowest since August 2021. Despite caveats from the shutdown, the cooler-than-expected readings supported investor optimism and contributed to equity gains following the release.

S&P Global’s Flash U.S. Composite Purchasing Managers’ Index (PMI) for December, released on Wednesday, fell to 53.0 from 54.2 in November—the lowest in six months. Readings above 50 indicate expansion, but growth slowed in both manufacturing and services sectors, with business confidence declining and price pressures intensifying.

Many strategists believe that a “Santa Claus rally” may be forthcoming. For those now aware, a Santa Claus rally is a historical tendency for the stock market to experience gains over the last five trading days of December and the first two trading days of January. According to Carson Investment Research, using data from FactSet as of December 22, 2025, and spanning from 1950, the S&P 500 index has experienced gains over 77% of the time, with an average gain of approximately 1.3% during the Santa Claus rally timeframe. Of course, this time could be different, and past performance is not indicative of future results.

As we enter the final weeks of the year, this time presents a great opportunity to reevaluate your financial picture and ensure that your portfolio is allocated appropriately for your current risk tolerance and objectives, as our market and economy continue to evolve.

Merry Christmas and Happy Holidays!

Equity and Fixed Income Index returns sourced from Bloomberg on 12/19/25. Employment and inflation data sourced from the Bureau of Labor Statistics on 12/16/25 and 12/18/25, respectively. Calendar Data from Econoday as of 12/22/25. International developed markets are measured by the MSCI EAFE Index, emerging markets are measured by the MSCI EM Index, and U.S. Large Caps are defined by the S&P 500 Index. Sector performance is measured using the GICS methodology.

Disclosures: Past performance does not guarantee future results. We have taken this information from sources that we believe to be reliable and accurate. Hennion and Walsh cannot guarantee the accuracy of said information and cannot be held liable. You cannot invest directly in an index. Diversification can help mitigate the risk and volatility in your portfolio, but does not ensure a profit or guarantee against a loss.