Investment Opportunities Within the AI Ecosystem

(To download a pdf copy of this white paper, please click this link )

At SmartTrust®, we look to provide diversified income and total return opportunities through innovative investment strategies. The majority of SmartTrust® Unit Investment Trusts (UITs) offer diversified income opportunities (as well as the potential for growth and total return) and have incorporated such underlying investment strategies as individual taxable and tax-free bonds, individual stocks, preferred stocks, business development companies (BDCs), closed-end funds (CEFs) and exchange-traded funds (ETFs). This report will focus on the growing and popular theme of artificial intelligence (AI) investing.

At a high level, we would define AI as the capability of a machine to imitate intelligent human behavior and defines machine learning as a subfield of artificial intelligence that gives computers the ability to learn without explicitly being programmed. However, in the sponsor’s view, the scope of AI in this context extends beyond imitating intelligent human behavior to potentially surpass human efficiency and accuracy in various specialized fields, where advanced systems are pushing the boundaries of what is possible, often achieving results beyond human capacity in areas like data analysis, predictive modeling, and complex problem-solving. Some examples of real-life applications of AI currently include, but are not limited to, the following:

- Navigation services such as Waze and Google Maps

- Facial recognition applications for security processes

- Voice activated personal assistants such as Siri and Alexa

- Cybersecurity and fraud detection solutions

- Smart home devices such as thermostats and security systems

- Autonomous driving vehicles

- Chatbots such as ChatGPT, Google Gemini, Microsoft Copilot, and Grok

- Drug discovery, medical diagnostics and surgical procedures

- Manufacturing and warehouse robotics

The above represents just a sampling of practical AI uses in society, and we have just scratched the surface. In fact, if we could borrow from a well-known baseball analogy, we would suggest that we are

only in “batting practice of a double-header” in terms of where we stand within the overall AI revolution. However, while many investors only consider chips/semiconductor companies for potential AI investment opportunities, we do not believe that AI is not isolated to any one area of the information technology sector but rather incorporates many different functional areas as part of its ecosystem. The functional areas that the sponsor believes comprise the ecosystem of enablers and adopters that help support the ongoing evolution of AI are Software, Chips/Semiconductors, Hardware, and Data Centers.

- Software – This functional area is comprised of companies that specialize in developing a wide range of software solutions aimed at addressing diverse needs across industries. These companies focus on creating applications, platforms and tools that facilitate data management, process optimization and task automation. The software offerings may include, but are not limited to, customer relationship management systems, enterprise resource planning software, project management tools and various applications that enhance business operations. These companies strive to provide software solutions that cater to the evolving demands of businesses, promoting efficiency, scalability and improved decision-making. Their products may cover areas such as data analytics, workflow management, collaboration tools, enhanced productivity and streamlined operations for organizations.

- Chips/Semiconductors – This functional area is comprised of companies that design and manufacture semiconductors or chips crucial for intensive data computations. Found in a wide range of products, including, but not limited to, computers, smartphones, appliances, gaming hardware and medical equipment, a semiconductor (or chip) is a material that conducts electricity more than an insulator but less than a pure conductor.

- Hardware – This functional area is comprised of companies that create physical devices and technology products such as sensors, robotics and specialized computing devices.

- Data Centers – This functional area is comprised of companies that can store and process large amounts of data using the high-performance servers and storage systems necessary to handle massive amounts of data. These data centers typically are Real Estate Investment Trusts (“REITs”) and fall within the Real Estate sector.

The robot image below may provide for a better visual of the four segments within the overall AI ecosystem.

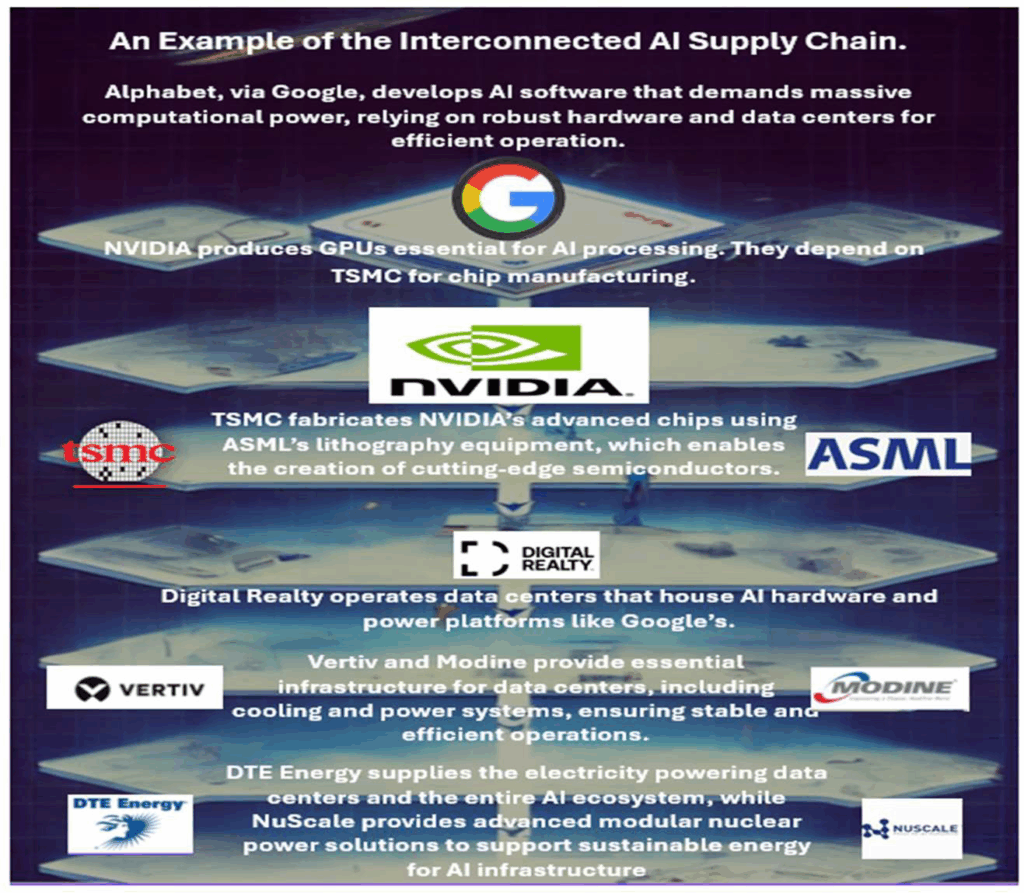

In our view, the success and advancement of AI hinge on the seamless integration and interdependence of the four functional areas, both enablers and adopters, within the AI ecosystem, as described above. In fact, if one looks at the AI supply chain they will gain an appreciation for the interconnected nature of its underlying companies. We attempt to capture the interconnected AI supply chain within the graphic below. McKinsey estimates that $6.7 trillion will be needed globally by 2030 to build data center infrastructure, with $5.2 trillion dedicated to supporting AI workloads alone. Roughly $2.1 trillion of that will go toward construction, power, and advanced cooling solutions—underscoring the critical role of infrastructure in sustaining the AI boom. The companies listed in this graphic are also portfolio components of certain series of the SmartTrust®, AI Ecosystem of Enablers and Adopters Trust (as described later in this whitepaper) and the SmartTrust®, Power Solution Trust.

The SmartTrust® Approach

The AI Ecosystem of Enablers and Adopters strategy from SmartTrust® seeks to provide investors with the possibility of total return potential through capital appreciation and dividend income. There is, of course, no guarantee that the investment objective of the Trust will be achieved. For this 2-year UIT strategy, we seek to achieve the Trust’s objective by investing in equity securities of companies that trade on a U.S. exchange, which the sponsor believes may benefit from enabling and/or adopting the utilization and application of artificial intelligence (“AI”).

To find these companies, we review company filings, websites and other publicly available information to determine each company’s involvement in the four segments of AI. To be included in the trust’s portfolio, we make the determination that AI is among the most significant factors that may potentially drive a company’s stock price performance over the next twenty-four months as of the time of deposit. To do so, we perform mainly qualitative assessments to reach our conclusions due to our view that publicly traded companies, even those focused on AI, are not universally transparent in sharing their exposure to AI at present. Specifically, our assessments are based upon their knowledge of:

- each company’s creation, adoption and/or consumption of AI products and services

- each company’s involvement in supplying of products and/or services that enable and help companies adopting, creating and/or using AI; and/or

- to the extent available, upon quantitative factors including but not limited to a company’s revenue derived from and/or resources devoted to AI.

As part of this analysis, we generally focus on observable and stated commitments to, capital expenditures within, and mergers/acquisitions or forecasts related to the four functional areas described above. as part of our final selection of the securities for each series of the Trust strategy, we seek to identify companies where AI may play at least a significant role in potentially driving a company’s stock price performance over the next twenty-four months, and then consider factors including, but not limited to, market capitalization, average trading volume, current dividend yield, trailing twelve-month free cash flow balances, revenues, earnings and analyst ratings.

Following this selection process, Series 2 of this 2-year Unit Investment Trust (UIT) strategy had the following portfolio composition.

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges, and expenses carefully before investing. The Prospectus contains this and other information relevant to an investment in the Trust. Please advise your clients to read the Prospectus carefully before they invest. If a prospectus did not accompany this literature, please contact SmartTrust® at (888) 505-2872 or visit www.smarttrustuit.com to obtain a free prospectus.