Harnessing the Power of the Energy Sector

To download a pdf copy of this white paper, please click this link or the pdf icon.) ![]()

Looking Beyond Oil for Investment Opportunities in North America

The rise of American energy independence over the last few years is a testament to the true spirt of American ingenuity and entrepreneurship. While America has been hostage to foreign suppliers of energy sources (i.e. crude oil) for years in order to satisfy our overall energy needs, this foreign dependency is now weening. Along with this detachment has come a domestic desire, which is also shared globally as evidenced by the Climate Change initiative that was recently agreed to in France late in 2015, to find alternative sources of energy that are cleaner and more sustainable. The combination of these two forces has created attractive investment opportunities in the energy sector overall across North America (which would include Canada and Mexico in addition to the U.S.).

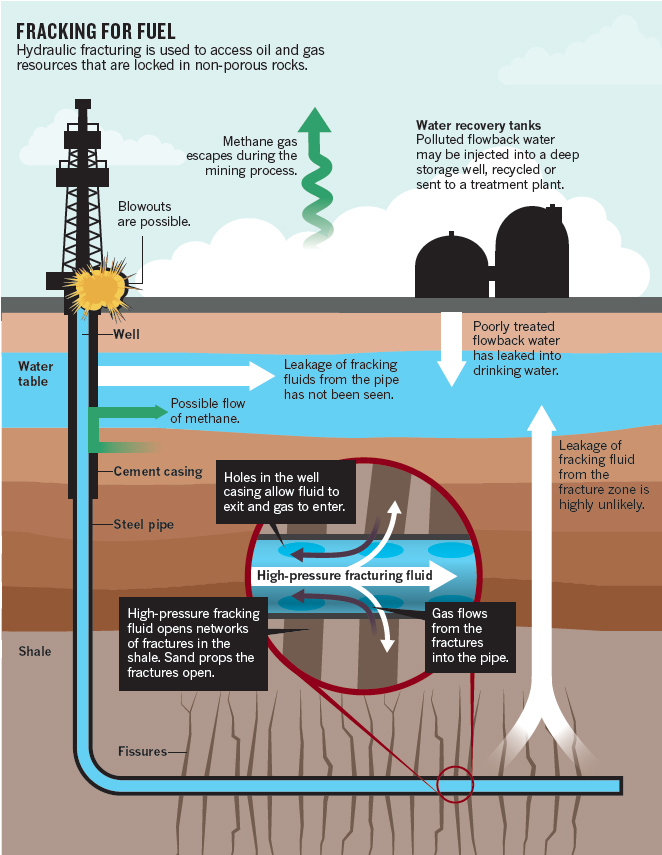

At the heart of the American energy renaissance is a process referred to as hydraulic fracturing (a.k.a. “fracking”). According to the United States Environmental Protection Agency, hydraulic fracturing produces fractures in rock formations underground that stimulate the flow of natural gas or oil, increasing the volumes that can be recovered. Wells may be drilled vertically hundreds to thousands of feet below the land surface and may include horizontal or directional sections extending thousands of additional feet. Hydraulic fracturing and horizontal drilling techniques have opened up new areas for both oil and gas development, with a particular focus on natural gas reservoirs such as shale.

Shale gas has become an increasingly important source of natural gas in the United States over recent years and at times is being discovered in certain parts of the country where oil or gas production has not previously taken place – an untapped gem if you will. The overall fracking process, and how it is different from conventional forms of oil and gas extraction, can likely better be understood by viewing the diagram below, recognizing that the fracking process is being used not only in the U.S. but across North America as well.

Source: UC Santa Barbara Geography/News & Events/Department News, “Supply Shock from North America Oil Rippling through Global Markets”, May 2013

The fracking revolution has been a roaring success thus far and is moving the U.S., in particular, closer to true energy independence. For example, according to the Energy Information Administration (EIA), approx. 49% of oil production and 54% of natural gas output in the U.S. is due to fracking. Looking out further, the National Petroleum Council estimates that fracking will eventually account for nearly 70% of natural gas production across North America. Fracking has become a vital component of the North American energy supply chain, which comes with its own unique set of risks including low oil prices, debt-leveraged companies, environmental concerns and legislative risks. These risks need to be carefully analyzed and accounted for as it is estimated that 45% of natural gas production and 17% of oil production would be lost within 5 years without fracking.

While the global supply tables vary each month, the United States has become the largest producer of oil and natural gas in the world on a more regular basis – overtaking both Russia and Saudi Arabia on the oil front likely at some point in 2014. The EIA has reported that domestic production of crude oil will account for 63% of total supplies in 2016, up from just 38% in 2011. Consider the growing, global production position of the U.S. since 2010, relative to Saudi Arabia and Russia, in the chart provided below.

Chart Source: “The story of the great American oil blob: U.S. Energy Boom: America is No. 1”, www.cnnmoney.com.

While the rise of energy production capabilities in North America has been impressive, the oil market has been mired in a historic decline of crude oil prices. This has largely been due to an oversupplied market in the face of relatively flat global demand. Of the 90 million barrels of crude oil supplied globally each day, it is estimated that there are approximately 800,000 barrels of oversupply. Saudi Arabia, in particular, continues to oversupply an already oversupplied market. As a result of this oversupply condition (which could be exacerbated with additional supply being exported from the likes of Iran and the U.S.), oil prices have recently hit a 12 year low and have even traded below $30 per barrel.

Some relief may be on the way for crude oil prices as the (OPEC) is reportedly considering mandating supply cuts, perhaps sooner than originally anticipated in 2016.

The natural gas story, on the other hand, is different from that of the crude oil story, and perhaps presents even more attractive investment opportunities. While global demand for oil is relatively flat, demand for natural gas is increasing. To this end, the EIA estimates that natural gas consumption will increase by 60%, on a global basis, by 2040.

Picture Source: www.designenergygroup.com/naturalgas

While natural gas prices can fluctuate based upon weather patterns, as we are seeing in the Northeast this winter season, additional factors supporting growth opportunities for natural gas moving forward, in our view, include the following:

- Natural gas is the cleanest burning fossil fuel and will continue to replace “dirty” coal energy sources in the months and years ahead

- The clean burning nature of natural gas is consistent with worldwide climate change initiative that was committed to during the December 2015 meetings in France

- Additional global demand for petrochemicals, which are used in the production of plastics for example, will continue to drive demands for natural gas worldwide

- While crude oil is a globally priced commodity, natural gas is a U.S. priced commodity and the U.S. is the largest producer and exporter of natural gas

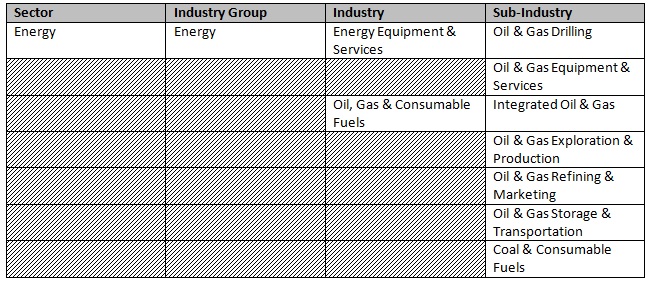

Those interested in investing in the previously described North American energy supply chain can look to the following types of company options to gain energy sector exposure, either through direct investments or through packaged product strategies (ex. mutual funds, exchange-traded funds, unit investment trusts, etc.). One such option would be to invest in the common stock of companies within the Energy sector based upon their industry and/or sub-industry and their country of domicile or incorporation. According the Global Industry Classification Standard (GICS), as published by Standard & Poor’s MSCI Barra, the following types of companies can be found within the Energy sector.

Investments in the stocks of certain companies within the Utilities sector could also be considered to gain a form of exposure to energy related developments as well.

Another available investment option is a Master Limited Partnership (MLP). A MLP is a limited partnership that is publicly traded on a given exchange and would also be represented in the GICS system described above. MLPs are often recognized for their tax benefits since they are pass-through entities that generally avoid corporate income tax at both state and federal levels since they are classified as partnerships. To qualify for these tax benefits, MLPs must earn at least 90% of their income from “qualified sources” as per the guidelines published by the Internal Revenue Service, such as natural resources. According to the National Association of Publicly Traded Partnerships, qualifying natural resources include:

- Oil, gas and petroleum products

- Coal and other minerals

- Timber

- Any other resource that is depletable under section 613 of the federal tax code

- Industrial source carbon dioxide

- Ethanol, biodiesel and other fuels (transportation and storage only)

MLPs are required to make distributions to their unit holders; which include limited partners and general partners, on a quarterly basis. As a result, MLPs can often be worthy of consideration for those investors who want exposure to the energy sector in addition to a higher relative level of tax-advantaged income.

There has been an ongoing shift from the types of MLPs outstanding towards the energy sector over the years, primarily due to the on-going redefinition of qualified sources of income.

Different Types of Energy MLPs

- Upstream MLPs: primarily involved in the exploration, recovery, development and production of crude oil, natural gas and natural gas liquids.

- Midstream MLPs: primarily involved in the gathering, storage and transportation of oils and gases. Pipelines are one such example of a midstream transportation operation. I often refer to midstream MLPs as “toll takers” as they earn their money based upon the storage and transportation of the fuels and are their valuations are not as influenced by price volatility of the underlying fuels themselves or the unpredictability of the exploration and development process overall. The majority of the MLPs currently available in the marketplace; energy and non-energy based, focus on midstream operations.

- Downstream MLPs: primarily involved in the distribution of the fuels to end customers, which include residential, industrial and agricultural entities.

Given the forward-looking optimism that many have for the energy sector, regardless of current oil prices, and the rising domestic and international demand for clean burning fossil fuels, we believe that investors should consider looking for ways to harness the power of the energy sector in North America within their own investment portfolios as appropriate.

——————————————————————————————————————————————

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust. Please advise your clients to read the prospectus carefully before they invest. If a prospectus did not accompany this literature, please contact SmartTrust® at (888) 505-2872 or visit www.smarttrustuit.com to obtain a free prospectus.