Sustainable Impact Investing

(To download a pdf copy of this white paper, please click this link or the pdf icon.) ![]()

The next step in the evolution of Socially Responsible Investing (SRI)

Updated April 27, 2021

At SmartTrust®, we look to provide for diversified income and total return opportunities through innovative investment strategies. The majority of SmartTrust® Unit Investment Trusts (UITs) offer diversified income opportunities (as well as the potential for total return) and have incorporated such underlying investment strategies as individual taxable and tax-free bonds, individual stocks, preferred stocks, business development companies (BDCs), closed-end funds (CEFs) and exchange-traded funds (ETFs). This particular report will focus on a growing trend amongst financial advisors and their clients across the country to invest in companies that provide for a sustainable global impact and include an overview of the innovative equities-based solution from SmartTrust® in this regard.

Sustainable impact investing is not necessarily something new to Wall Street but rather the next step in the evolution of socially responsible investing (SRI) strategies. For those who may not be aware, socially responsible investing is an investment style that uses both positive and negative screens to include or exclude companies in a portfolio based on social, moral, ethical, and religious criteria. For most of the existing SRI strategies in the marketplace, this equates to an exclusionary process that excludes companies who may have a certain percentage of their revenue derived from areas such as weapons, tobacco, alcohol, or gambling. Other strategies may look to exclude the stocks of companies in certain industries, or sub-industries, which are associated with these socially taboo areas. One of the oldest, and most recognized SRI indexes, is the Domini 400 Index. This index, which is now the MSCI KLD 400 Social Index, was launched in 1990 and currently uses the MSCI USA IMI ESG Index as its selection universe. According to its stated index methodology, companies involved in the following activities are excluded from the index:

• Alcohol

• Gambling

• Tobacco

• Military Weapons

• Civilian Firearms

• Nuclear Power

• Adult Entertainment

• Genetically Modified Organisms

Some critiques of traditional socially responsible investing strategies are that they often do not consider the investment merits of a given company’s stock and that they excluded companies that were perhaps “sinful” in certain areas, but were providing positive, sustainable characteristics in other areas. Limiting the sectors or industries that are included in a given investment portfolio can also hinder potential diversification and/or growth of capital opportunities.

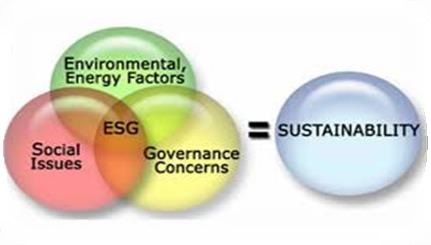

Sustainable, responsible, and impact investing, on the other hand, offers what I believe to be a more dynamic approach to investing in this rapidly growing area. This type of investing involves more of a positive, proactive, and comprehensive review of a company to provide for a more robust picture of the company’s operations and social and economic impact. Factors considered for this type of investing generally fall into the categories of environmental, social, and corporate governance (ESG).

Picture Source: www.dealmarketblog.com

Investopedia defines the application of these factors as a set of standards for a company’s operations that socially conscious investors use to screen investments.

• Environmental criteria look at how a company performs as a steward of the natural environment

• Social criteria examine how a company manages relationships with its employees, suppliers, customers, and the communities where they operate

• Governance deals with a company’s leadership, executive pay, audits, internal controls, and shareholder rights

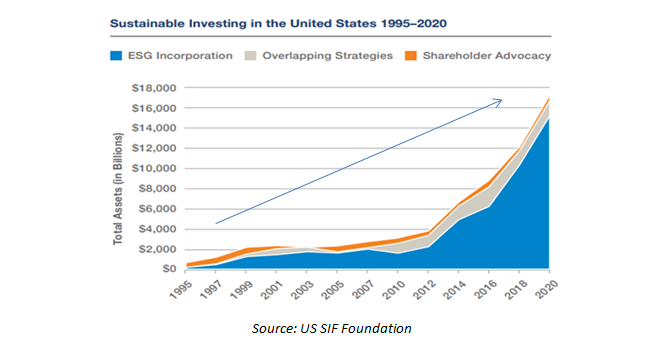

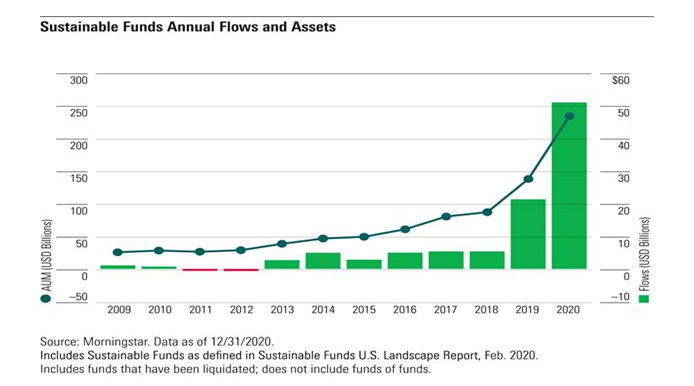

Through impact investing, investors will look to invest in businesses or investment strategies that combine both social and financial returns. Investment funds (i.e., mutual funds, variable annuity funds, closed-end funds, exchange-traded funds, alternative investment funds, and other pooled products), and the assets that are invested through them) incorporating ESG factors have grown considerably since 1995. According to the US SIF Foundation, assets have increased more than 25-times, with a compound annual growth rate of 14%, since 1995, when the size of the U.S. sustainable investment universe was “just” $639 billion. The most rapid growth has taken place in recent years as total U.S.-domiciled assets under management using sustainable investing strategies grew by 42% from $12 trillion at the beginning of 2018 to over $17 trillion at the start of 2020 (see chart below). According, again, to the US SIF Foundation, this represents 33 %, or $1 in every $3, of the roughly $51 trillion of total U.S. assets under professional management.

Even more recently, Sustainable Funds that incorporate ESG factors captured $51.1 billion of net new money from investors in 2020 – a record and more than double the prior year, according to Morningstar.

Some Wall Street investment firms are promoting the benefits that sustainable impact investing has in their investment platforms. For example, according to Morgan Stanley’s website, they will “…expand the Investing with Impact Platform through new products and innovative thematic portfolios to meet rapidly rising client demand for new opportunities. The Firm has set a five-year goal of $10 billion in total client assets through the Investing with Impact Platform.” As another example, Goldman Sachs Asset Management stated in a January 2013 article entitled, “GSAM Statement on Responsible and Sustainable Investing,” that “We believe responsible and sustainable investing extends beyond the evaluation of quantitative factors and traditional fundamental analysis. Where material, it should include the analysis of an entity’s impact on its stakeholders, the environment, and society. We recognize that these environmental, social, and governance (ESG) factors can affect investment performance, expose potential investment risks, and provide an indication of management excellence and leadership.”

The rising trend toward the “new SRI” is not limited to the United States. Assets under management incorporating sustainability investment strategies reached $30.7 trillion globally as of the beginning of 2018, an increase of 34% in just two years, said the “Global Sustainable Investment Review 2018,” released by the Global Sustainable Investment Alliance. In all of the regions included in the review except Europe, sustainable investing’s market share has also grown, ranging from 18% in Japan to as high as 63% in Australia and New Zealand. Interestingly, the most significant increase over the past two years was in Japan, where sustainably managed assets grew over 300%, followed by Australia/New Zealand and Canada.

Additionally, according to an older Merrill Lynch article entitled, “Socially responsible investing: Aligning your principles with your investing goals,” managers representing 15% of the world’s investable assets committed to socially responsible investing in 2013 and managers/strategies representing more than $45 trillion in assets committed to investing through the United Nations Principles for Responsible Investment (UNPRI) in 2014.

The UNPRI is at the core of the global sustainable and responsible investment movement. The Principles for Responsible Investment were developed by an international group of institutional investors reflecting the increasing relevance of environmental, social, and corporate governance issues to investment practices. The United Nations Secretary-General convened the process. These are the six stated principles:

• Principle 1: We will incorporate ESG issues into investment analysis and decision-making processes.

• Principle 2: We will be active owners and incorporate ESG issues into our ownership policies and practices.

• Principle 3: We will seek appropriate disclosure on ESG issues by the entities in which we invest.

• Principle 4: We will promote acceptance and implementation of the Principles within the investment industry.

• Principle 5: We will work together to enhance our effectiveness in implementing the Principles.

• Principle 6: We will each report on our activities and progress towards implementing the Principles.

Companies are invited to apply to become a signatory of the UNPRI if they can demonstrate their commitment to responsible investment and desire to be at the heart of the global community seeking to build a more sustainable, overall financial system. There are three categories of signatories to the UNPRI, which include asset owners (288), investment managers (884), and professional service partners (187).

The SmartTrust® Approach

The innovative approach to sustainable, responsible impact investing at SmartTrust® combines the research solutions provided by JUST Capital that help financial professionals evaluate the environmental, social, and governance performance of companies with the equity management and research expertise of Argus Research Company.

JUST Capital was co-founded in 2013 by a group of concerned people from the worlds of business, finance, and civil society – including Paul Tudor Jones II, Deepak Chopra, Rinaldo Brutoco, Arianna Huffington, Paul Scialla, and others. JUST Capital utilizes a combination of data-driven research and strategic engagement to shift norms and practices in corporate America and the financial markets. JUST Capital is a not-for-profit 501(c)(3) registered organization whose mission is to drive measurable corporate change to create a stakeholder-centric, inclusive form of capitalism that reflects the priorities of the American public. JUST Capital’s rankings, investable indexes, and in-depth financial analysis demonstrate the business and investor case for just business behavior. JUST has one goal: to drive investment capital toward more just companies, thereby incentivizing a more just and equitable marketplace.

Argus Research Company, on the other hand, produces independent research for investors. Since 1934, their business has been to produce, distribute and market high-quality investment and economic research. Their recommendations reflect the judgment of an analyst about a company’s prospects as an investment in terms of value, expected growth, and risks. Their research system involves rigorous quantitative analysis of a company’s growth prospects, financial strength, and valuation. The framework also requires detailed qualitative analysis into the company’s industry, the risks it faces, and, most importantly, the quality and integrity of its management team.

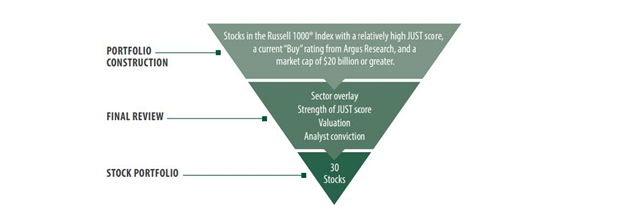

Utilizing JUST Capital’s unique rating process, the SmartTrust® Sustainable Impact Investing Trust strategy digs deeper to incorporate a more comprehensive SRI/ESG portfolio while introducing a performance element using Argus Research.

JUST starts the process by polling Americans to identify the issues that matter most in defining just business behavior today and then evaluates America’s largest publicly traded companies on the issues. As opposed to relying solely upon traditional ESG factors, JUST conducts the polling mentioned above of Americans to help identify the issues that matter most in defining just business behavior. Examples include fair pay, ethical leadership, customer privacy, environmental impact, and job creation. JUST takes a total of 29 individual issues into account, which are organized along five stakeholder categories:

1. Workers

2. Customers

3. Environment

4. Communities

5. Shareholders

JUST generates scores for each issue before aggregating to obtain an overall score for companies included in the Russell 1000® Index.

From companies that have been scored by JUST, the portfolio consultant, Argus Investors’ Counsel, Inc., selected the portfolio from equity securities with a “Buy” rating from Argus Research Company, an affiliate of the portfolio consultant, and a relatively high JUST score. A “Buy” rating means that Argus Research Company estimates a security to deliver a risk-adjusted return that beats the S&P 500 Index over the next 12 months. The portfolio consultant only considered large-cap companies (which it defines as companies with market capitalizations greater than $20 billion) for inclusion in the Trust’s portfolio. In selecting the final portfolio, the portfolio consultant applied a sector overlay to the remaining securities and considered the following additional factors: (i) strength of a security’s JUST score, (ii) the reasonableness of the valuation of the company, and (iii) analyst conviction. It is a fundamental policy of the Trust to invest, under normal circumstances, at least 80% of the value of its assets in sustainable impact investments. Sustainable impact investments include investments made based on environmental, social, and/or corporate governance factors.

Argus applies the selection criteria before each series of the Trust’s formation. As a result, it is possible that the securities do not meet certain of the selection criteria as of the initial date of deposit of each series of the trust strategy.

While there is nothing inherently wrong with traditional socially responsible investing strategies, and incorporating exclusionary screening factors such as tobacco, weapons and gambling certainly have their merits and appreciative audience of investors, we feel that our approach to sustainable impact investing represents the next step in the evolution of socially responsible investing and can be consistent with investors’ attitudes towards promoting a sustainable, responsible world and desires for competitive investment return. In other words, these two objectives no longer need to be mutually exclusive.

According to the JUST Capital website, “With your voice, your purchase decisions, your investment dollars, your career choices, your leadership, you have the power to make the world a more just place.” In our view, the SmartTrust®, Sustainable Impact Investing Trust, is worthy of consideration for investors who share this vision.

——————————————————————————————————————————————

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges, and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust. Please read the prospectus carefully before invesingt. If a prospectus did not accompany this literature, please contact SmartTrust at (888) 505-2872 or visit www.smarttrustuit.com to obtain a free prospectus.