Finding Opportunities in Healthcare through Biotech

To download a pdf copy of this white paper, please click this link or the pdf icon.) ![]()

Finding Opportunities in Healthcare through Biotech

At SmartTrust®, we look to provide for diversified income and total return opportunities through innovative investment strategies. The majority of SmartTrust® Unit Investment Trusts (UITs) offer diversified income opportunities, as well as the potential for total return, and have incorporated such underlying investment product types as individual taxable and tax-free bonds, individual stocks, preferred securities, business development companies (BDCs), closed-end funds (CEFs), real estate investment trusts (REITs), American depository receipts (ADRs), master limited partnerships (MLPs) and exchange-traded funds (ETFs). This particular report will focus on the opportunities that we see in the healthcare sector, which has total revenues of $1.05 trillion on a global basis*, in the months and years ahead and ways to potentially take advantage of these opportunities through investments in biotech companies.

Scientific and technological innovations continue to propel opportunities in the healthcare sector. Some of the catalysts that have led to increased investment spending in the healthcare sector include, but are not limited to, the following:

• An increased understanding of the disease mechanism

• Genomics enabling precision medicine

• Improved therapeutics

In conjunction with these innovations are certain demographical trends listed below that are feeding into the overall demand for healthcare solutions:

• Increase in life expectancies in general

• An aging population that is represented by more than 1.4 billion people globally being over the age of 60 by the year 2030

• The degree to which our aging population will spend money on healthcare, recognizing that half of all lifetime healthcare expenditures occur from the age of 65 and upwards

• Increase in the rate of chronic illnesses globally

Accepting that there is a greater demand for healthcare solutions today and an increase in the types of healthcare solutions that are now available (or are on track to someday be available), the question then becomes how best to find investment opportunities within the healthcare sector?

While valid systemic concerns can be presented with respect to the potential negative impact of regulatory measures, such as the Affordable Care Act (a.k.a. “Obamacare”), on the healthcare sector and heightened pricing scrutiny on drugs and healthcare products in general, we believe that these risks are primarily borne by large pharmaceutical companies. These large pharmaceutical companies also face the risk of falling off a “patent cliff” in the upcoming years as several of their larger revenue producing drugs are scheduled to come off patent and face generic competition. To this end, in 2016 alone, drugs with pre-expiration values totaling a combined $56.4 billion are subject to this aforementioned patent cliff according to S-Network Global Indexes, Inc.. Some of the more noteworthy examples of drugs/companies that will be, or have been, subjected to the patent cliff from 2011 – 2020, based on data from Anthony Crasto’s Patent Related Site, can be found below:

As a result of these patent expirations, large pharmaceutical companies will need to look to replace these sources of lost revenue while also finding ways to help minimize the systemic concerns cited earlier. In order to accomplish this, some might suggest that they should turn to their own research and development (R&D) for a pipeline of new drugs and solutions. The problem is that the majority of larger pharmaceutical companies has not been investing adequately, or successfully, in their own R&D and thus do not have a pipeline where they can confidently turn. Before casting any aspersions on “big pharma” in this regard, one should understand that the R&D process in the healthcare sector is not an elementary one and often results in expensive and non-successful results. For example, it is estimated that the development of a new drug costs around $2.6 billion on average and that less than 12% of the developed drugs that make their way to clinical trials ultimately win regulatory approval from the Food and Drug Administration (FDA)*.

From our perspective, this quandary presents investment opportunities not only for manufacturers of generic drugs but also for biotechnology (“biotech”) companies focused on innovation as big pharmaceutical companies will likely look to acquire these companies to help replace revenue lost to the patent cliff. As opposed to the multi-pronged focus of large pharmaceutical companies, the primary focus of biotech companies is to develop new and innovative healthcare solutions. While this focus does not make the process of bringing a new drug to market any easier or less expensive, the previously mentioned patent cliff and recent momentum on the side of regulatory approvals present reasons for biotech optimism. With respect to the latter, 45 new drugs were approved by the FDA in 2015. This represented the second-highest total of drug approvals in at least 35 years and half of the drugs that were approved were for rare diseases.*

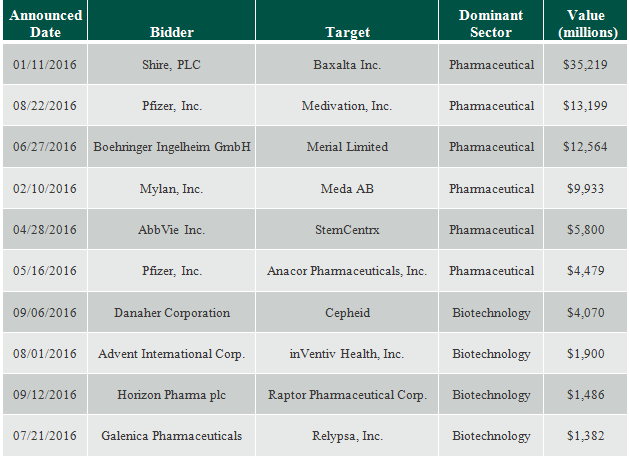

Biotech companies with approved drugs, or drugs believed to be near the final approval stage should look very attractive from a mergers and acquisitions (M&A) standpoint to large pharmaceutical companies in this environment. In this regard, there was $219.4 billion in worldwide Biopharma M&A transaction volume in 2015 and $130.7 billion thus far in 2016 (the top 10 of which are listed below) according to data from Biopharm Insight provided by S-Network Global Indexes, Inc., including completed and announced deals, asset deals and acquisitions of divisions. This is a trend we see continuing in the future.

Top Ten Deals – 2016 YTD through September 14, 2016

Source: Biopharm Insight, as provided by S-Network Global Indexes, Inc., 2016 Year-to-Date (YTD) deals through 9/14/16.

One SmartTrust® unit investment trust (UIT) strategy that invests primarily in biotech companies is the Healthcare Innovations Trust. The trust seeks to pursue its objective by investing in a portfolio consisting of equity securities comprising the Poliwogg Healthcare Innovation Index. The developer of this Index is Poliwogg Services, LLC (“Poliwogg”) and the publisher of the Index is S-Network Global Indexes, Inc. (“SNGI”). Poliwogg is a financial services company whose mission is to create financial products that give both institutional and retail investors the opportunity to invest in dynamic sectors and subsectors of the life sciences—medical innovations and breakthroughs. SNGI publishes over 200 indexes, which provide the foundations for exchange-traded funds.

As described in the Trust’s Prospectus, all stocks selected for inclusion in the underlying Index;

• must be listed on a U.S. stock exchange and principally engaged in one of the following health care sectors:

• a) biotechnology , or

•b) pharmaceuticals

• must have a market capitalization of no less than $1 billion and no more than $50 billion.

• must sustain an average daily trading volume in excess of $1 million for the 90-day period preceding a reconstitution.

• must have one or more drugs in either Phase II or Phase III U.S. Food and Drug Administration (FDA) clinical trials which are not in a partnership.

•As a point of reference, a Phase II FDA clinical trial generally means a drug or treatment is given to a larger group of people to see if it is effective and to further evaluate its safety and a Phase III FDA clinical trial generally means a drug or treatment is given to large groups of people to confirm its effectiveness, monitor side effects, compare it to commonly used treatments, and collect information that will allow the drug or treatment to be used safely.

• must also have drugs which meet one of the following criteria:

• breakthrough, fast track or orphan drug status by the FDA (all three of these status are described below), or

•expected catalyst (estimated time until FDA approval) within the next 24 months.

•A “breakthrough” therapy is a drug intended alone or in combination with one or more other drugs to treat a serious or life threatening disease or condition and preliminary clinical evidence indicates that the drug may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development.

•“Fast track” is a process designed to facilitate the development, and expedite the review of drugs to treat serious conditions and fill an unmet medical need.

•The Orphan Drug Designation program provides “orphan status” to drugs and biologics which are defined as those intended for the safe and effective treatment, diagnosis or prevention of rare diseases/ disorders that affect fewer than 200,000 people in the U.S., or that affect more than 200,000 persons but are not expected to recover the costs of developing and marketing a treatment drug.

The number of stocks contained in the Index is fixed at 30 at the time of each reconstitution. For more information on this Trust’s investment strategy, or any other UIT outstanding from SmartTrust®, please consult the prospectus by contacting our Internal Support Desk at 888-505-2872 or visiting www.smarttrustuit.com.

*Source: July 31, 2016 article on The Motley Fool by Keith Speights entitled, “12 Big Pharma Stats That Will Blow You Away”

——————————————————————————————————————————————

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust. Please advise your clients to read the prospectus carefully before they invest. If a prospectus did not accompany this literature, please contact SmartTrust® at (888) 505-2872 or visit www.smarttrustuit.com to obtain a free prospectus.