Investing in the New Technology Revolution

To download a pdf copy of this white paper, please click this link or the pdf icon.) ![]()

Investing in the New Technology Revolution

Kevin D. Mahn

Chief Investment Officer

May 2018

At SmartTrust®, we look to provide for diversified income and total return opportunities through innovative investment strategies. We use a bottoms-up approach to develop our Unit Investment Trust (UIT) product strategies, based in large part on the input received from the many advisors we are fortunate to work with across the country. In so doing, we look to only bring products to market when the strategy has value in the market and demand from the marketplace. The majority of SmartTrust® UITs offer diversified income opportunities, as well as the potential for total return, and have incorporated such underlying investment product types as individual taxable and tax-free bonds, individual stocks, preferred securities, business development companies (BDCs), closed-end funds (CEFs), real estate investment trusts (REITs), American depository receipts (ADRs), master limited partnerships (MLPs) and exchange-traded funds (ETFs). This particular report will focus on the growth opportunities that we see in the stocks of companies engaged in areas of technology believed to be revolutionary.

For these purposes, we define companies engaged in revolutionary technologies to be those that are principally engaged in or that derive significant revenues from businesses in:

• artificial intelligence,

• blockchain,

• cybersecurity,

• financial technology,

• internet of things and

• robotics.

Photo Credit: GR Advisory & Training – WordPress.com

Technology continues to change the way we interact in society on both a social and economic front. While the amount and type of new technologies appearing in the marketplace seem never-ending, there are certain technologies that we have identified that appear to be transformative in nature. These identified technologies have the ability to ultimately transform the bottom line of those companies, across multiple industries, which embrace them by transforming the way in which they operate. In the past, most people have thought about technology innovations as essentially task rabbits. Going forward, with smart sensors, leaps in artificial intelligence (AI) and the integration of robotics with the Internet of Things (IoT), the NEW technology revolution is about coevolving human intelligence with robotics and AI to enhance everything we do from play to work. The world is quickly advancing to the point where human cognitive abilities are not necessarily replaced but rather are enhanced and improved. To better understand our perspective, let’s take a deeper dive into some of these identified technologies, recognizing that many of these technologies feed off of one another and are often intertwined.

1. Artificial Intelligence (AI)

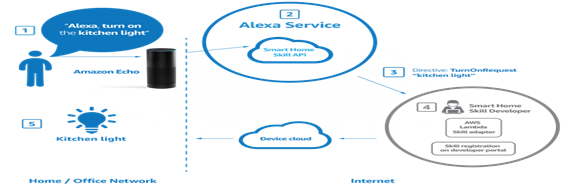

Artificial intelligence (AI), also referred to as “deep learning”, is typically associated with companies whose technologies are focused on the automation of cognitive processes such as speech recognition, deep learning and visual navigation. Finding ways to use artificial intelligence to their competitive advantage is at the top of the minds of many business managers. In this regard, a PwC study of 2,500 U.S. consumers and business decision makers, as published by CMO on April 25, 2017, found that business leaders, specifically, believe AI is going to be fundamental in the future – and 72% termed it a “business advantage.” One such example of a game-changing application of AI is Amazon’s voice assistant “Alexa” product, which is a part of its popular Echo smart speaker. RBC Capital Markets estimates that this AI-based product could bring the company $10 billion of revenues by the year 2020 according to CNBC in a March 10, 2017 article. One example of how artificial intelligence can help with everyday functions, such as turning on a light in a home, using a technology such as the Alexa service, is illustrated below.

Source: Amazon Echo Diagram, diaoyurcom.com

2. Blockchain

Blockchain is perhaps best known as the underlying technology supporting several cryptocurrencies, including Bitcoin. This, however, is not the only current application of blockchain technology and its potential use is anticipated to spread to different areas in the future as well. At its core, blockchain has been described as being a decentralized, distributed and public digital ledger that is used to record transactions across many computers so that the record cannot be altered retroactively without the alteration of all subsequent blocks and the collusion of the network. Hence, the efficiency and security offered by the technology could be beneficial to a wide variety of applications within many different sectors. To this end, according to the Global FinTech Report 2017 PwC, blockchain could make the financial services industry’s infrastructure much less expensive and the list of potential uses is almost limitless, from financial transactions to automated contractual agreements and more. Further, according to the same Global FinTech Report 2017 from PwC, 77% of the Financial Services companies that were surveyed expect to adopt blockchain as part of an in-production system or process by the year 2020.

Blockchain technology appears to us to be a real game changer and we are not alone in this belief. According to an article entitled, “The Impact of Blockchain Goes Beyond Financial Services” in the Harvard Business Review, “The technology most likely to change the next decade of business is not the social web, the cloud, robotics or even artificial intelligence. It’s the blockchain.”

3. Cybersecurity

Cybersecurity technologies are generally used to protect computers, devices, servers or networks against unauthorized access or attack. There have been several noteworthy cyber-attacks, affecting companies in different industries, in recent years that have caught everyone’s attention due to the extent of the attack and amount of damages. These attacks include, but are not limited to, the following:

• Yahoo – 3 billions impacted user accounts

• eBay – 145 million users compromised

• Equifax – 143 million consumers exposed

• Target – 110 million people compromised

Source: CSOonline.com, “The 17 Biggest Data Breaches of the 21st Century”, By Taylor Armstrong, January 26, 2018.

Photo credit: Cyber Security – Sev1Tech

4. Financial Technology (FinTech)

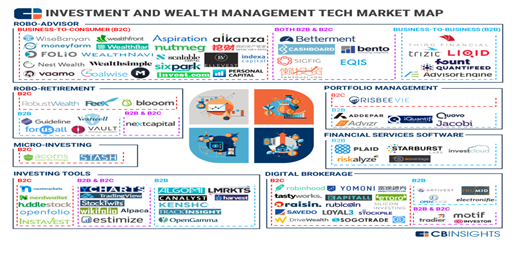

These would be defined by companies whose technologies support banking, financial advice, investment and related services. Some of the more well-known examples of financial technology (FinTech) include the online payment processor, Paypal, the peer-to-peer lending site, Lending Club, the mobile stock trading application, Robinhood and the “Robo-advisor” software from Betterment. Each of these technologies intends to improve the overall user experience in their functional area at a reasonable cost. As a result of the disruptive nature of FinTech, a great deal of interest, in the form of venture capital financing, has been placed on the area. For example, according to a Global Fintech Report from CBInsights, in the first quarter of 2017:

1. Global venture capital-backed FinTech start-ups raised $2.7 Billion across 226 deals.

2. Asian venture capital-backed FinTech start-ups raised $826 Million across 42 deals.

3. European venture capital-backed FinTech start-ups raised $667 Million across 73 deals.

4. U.S. venture capital-backed FinTech start-ups raised $1.1 Billion across 90 deals

Financial institutions continue to partner with FinTech companies as well to leverage their technologies for their own benefit, with observed partnerships increasing from 32% in 2016 to 45% this year on average according to CBInsights.

Chart credit: CBInsights

Finally, we would not be surprised to see more mergers and acquisition (M&A) activity in the Fintech arena in the months and years ahead as financial services firms and larger technology firms weigh out the pros and cons of buying or building their own in-house FinTech capabilities.

5. Internet of Things (IoT)

These would be defined by companies whose technologies involve the internet of computing devices embedded in everyday objects. To grasp the potential of IoT, one needs to understand how it fits into the Fourth Industrial Revolution, also known to many as Industry 4.0. Industry 4.0 promotes a more connected world in which machines carry out daily, basic tasks. According to a CMO article entitled, “15 Mind-Blowing Stats about Emerging Technology”, in 2008, there were already more “things” connected to the internet than people. Additionally, by 2020, the amount of internet-connected things will reach 50 billion (including 90% of all cars), with $19 trillion in profits and cost savings coming from IoT estimated over the next decade.

Photo credit: SemiElectronics

While Industry 4.0 is often associated with the idea of the smart factory, it also ranges outside the factory and into product design which is often fed by smart sensor technology where sensors in one’s home, or car or office building record how and when you use devices and make improvements based on that data. Over the years, these types of “big data” have been gathered and stored without necessarily knowing what exactly to do with the all of the terabytes of information. Industry 4.0 will begin to process and utilize all of the data more efficiently. The potential opportunities are endless – consider a car that schedules a service visit when it senses a part in need of repair or a refrigerator that orders a new water filter when it senses the current one is near its expiration….and these are just two basic examples!

6. Robotics

These would be defined by companies whose technologies are focused on the automation of physical processes such as manufacturing, surgery and transportation. Building a robot to replace certain functions normally performed by a human being is nothing new. For example, the use of robotics can be seen in warehouses, factories and distribution centers by well-known firms including, but not limited to, Amazon. While these functions have historically been mundane, they are now being replaced by more complicated, delicate and intricate functions such as surgery. For example, there are the Intuitive Surgical da Vinci robots that can arguably perform delicate surgery better than most, if not all, human doctors.

Photo credit: Robotics – HowtoLearnBlog”

Drones are yet another example of advancements in robotics. Drones are a relatively cost effective solution that are currently being used for surveying physical processes, whether they are happening on a construction site, in a field, or assisting with security control in defined areas. The uses of drone technology are expected to expand significantly in the future. According to a recent report by PwC, as published by CMO, the drone industry could be worth as much as $127 billion by 2020, with some of the greatest application increases in areas such as business, farming, and special effects applications.

It should be noted that advancements in robotics do not necessarily involve the replacement of human labor but often involve the refinement or enhancement of human labor capabilities through automation. To this end, according to a 2017 report from Adobe Digital Insights (ADI), automation mentions online have doubled year-over-year, and average daily mentions of robots and jobs have increased 70% year-over-year.

A SmartTrust® UIT Strategy for the Technology Revolution

At SmartTrust®, we approached the idea of building an investable portfolio of companies associated with revolutionary technologies very methodically. In so doing, we wanted to try to identify companies:

• that are publicly listed and trading on a North American exchange

• whose performance was more closely connected with one of the identified technologies than other potential sector, industry or company factors

• have demonstrated capabilities developing or using one of the identified technologies

• have the potential for earnings and stock price growth

To help with the identification of these companies, following these parameters, we started by licensing the rights to the S-Network North American Disruptor IndexSM. By so doing, we are able to obtain an initial population of securities to further run our own proprietary selection criteria against.

The underlying S-Network North American Disruptor IndexSM index includes both companies that provide disruptive technologies and companies that use disruptive technologies in the six identified areas of technology, also referred to as segments, previously described in this whitepaper. The constituents of the index must be listed on a North American stock exchange and have a market capitalization of no less than $100 million and no more than $10 billion, though index eligibility criteria is subject to a 10% buffer for constituents in the Index prior to reconstitution. Constituents must have a float market capitalization of no less than $50 million. Constituents must meet minimum price and liquidity thresholds. Finally, certain companies that are not principally engaged in one or more of the six segments, but that derive significant revenues from businesses in one or more of the six segments may be included in the index at the discretion of the Index Committee on a capitalization-adjusted basis, provided that*:

1) such revenues represent more than 20% of the company’s total revenues and such revenues are independently reported in the company’s financial reports,

2) applicable revenues are likely to have a material impact on the company’s overall share price performance, and

3) the company’s applicable business is likely to have a significant impact on the sector as a whole.

*Index eligibility criteria is determined as of the last business day of the month preceding the reconstitution month

From here, we look to apply our proprietary selection criteria to this initial population of securities to arrive at a final portfolio consistent with the investment objective of the SmartTrust®, Technology Revolution Trust. This Trust seeks total return potential through capital appreciation and dividend income by investing in a portfolio consisting of the equity securities of companies engaged in technologies we believe to be “revolutionary”. Factors considered in the selection criteria include, but are not limited to, the following:

• market capitalizations;

• cash flow (through trailing twelve month free cash flow balances);

• revenues (through revenue per share and revenue growth);

• earnings (through earnings per share growth);

• profits (through gross profits and profit margins);

• valuations (through current and forward price/earnings, price/book and current and

• forward looking price/earnings growth ratios);

• dividends (through dividend yield and dividend growth rates);

• analyst coverage and analyst ratings; and

• average trading volumes.

The resulting portfolio of small to mid-cap stocks is approximately equally weighted. There will not necessarily be at least one company in each of the six defined technology areas in each series of the Trust strategy, though this may be the case as we saw in Series 1. For further edification, an example of one company from each of the six defined technology areas that happen to be in Series 1 of the SmartTrust®, Technology Revolution Trust as of the deposit date can be found below. The source of the company descriptions for each company listed is Bloomberg and company websites.

Artificial Intelligence (AI)

Cognex Corporation – designs, develops, manufactures, and markets machine vision systems. The Company’s systems are used to automate the manufacture of a variety of discrete items and to assure their quality. Cognex has regional offices located throughout North America, Japan, Europe, and Southeast Asia. According to the company, machines might not possess big picture vision, but Cognex machines have excellent vision when it comes to detail. The company is one of the world’s largest producers of systems that, linked to a video camera, serve as eyes where human vision is insufficient. Semiconductor, consumer goods, health care and automotive companies, among others, use the company’s machine vision and industrial identification systems to position and identify products, gauge sizes and locate defects.

Blockchain

Virtusa Corporation. –operates as an information technology services company. The Company offers technology consulting and implementation, business process management, mobility, business consulting, cloud, and application outsourcing services. Virtusa serves customers worldwide. Virtusa’s customers come from industries such as financial services, insurance, telecommunications, media and healthcare. According to the company, they have eliminated or reduced the role of alternate currencies to focus on the use of underlying technologies for process improvement purposes. This has resulted in their own “Blockchain Exploration Center”. One such example of their innovation through experimentation within their Blockchain Exploration Center is research around extending distributed ledgers to simplify the long standing complexity in the Insurance brokerage industry.

Cybersecurity

Imperva Inc. – develops protection software and services for databases and business applications. The Company offers data security, monitoring, and web application security to the energy, financial services, government, healthcare, insurance, retail, and e-commerce industries. Imperva offers their products and services around the world.

Financial Technology (FinTech)

HealthEquity, Inc. – provides technology-enabled services platforms that allow consumers to make healthcare saving and spending decisions. Consumers can access their tax-advantaged healthcare savings, compare treatment options and pricing, evaluate and pay healthcare bills, receive personalized benefit and clinical information, and earn wellness incentives.

Internet of Things (IoT)

Silicon Laboratories Inc. – is a provider of silicon, software and solutions for the Internet of Things (IoT), internet infrastructure, industrial control, consumer and automotive markets. The Company solves problems in the electronics industry providing customers with significant performance, energy savings, connectivity and design simplicity.

Robotics

John Bean Technologies Corporation – operates as a technology solution provider. The Company designs, manufactures, tests, and services systems and products for global industrial food processing customers through its FoodTech segment and for domestic and international air transportation customers through its AeroTech segment.

While no screening criteria can guarantee a positive total return, we believe that the security selection approach employed at SmartTrust®, as described throughout this whitepaper, can be helpful in creating a portfolio strategy that seeks to provide total return potential during the life of the Trust by investing in companies taking part in the technology revolution. It is our contention that the new technology revolution will ultimately transform economies, jobs, and society overall.

If you are interested in learning more about this particular Trust strategy, or any of our other innovative UIT portfolio strategies, please contact your Financial Advisor or visit www.smarttrustuit.com.

——————————————————————————————————————————————

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust. Please advise your clients to read the prospectus carefully before they invest. If a prospectus did not accompany this literature, please contact SmartTrust® at (888) 505-2872 or visit www.smarttrustuit.com