Screening for Preferred Securities

To download a pdf copy of this white paper, please click this link or the pdf icon.) ![]()

Screening for Preferred Securities

At SmartTrust®, we look to provide for diversified income and total return opportunities through innovative investment strategies. The majority of SmartTrust® Unit Investment Trusts (UITs) offer diversified income opportunities, as well as the potential for total return, and have incorporated such underlying investment product types as individual taxable and tax-free bonds, common stocks, preferred securities, business development companies (BDCs), closed-end funds (CEFs), real estate investment trusts (REITs), American depository receipts (ADRs), master limited partnerships (MLPs) and exchange-traded funds (ETFs). This particular report will focus on the selection criteria that we typically employ to select preferred securities.

Preferred securities, also commonly referred to as preferred stocks, represent a hybrid security type combining different features of both equities and debt. Though they have “stock” in their name, preferred stocks generally fall under the taxable fixed income asset class. Their unique features include, but are not limited to, the following:

• Preferred securities have a relatively high, fixed distribution rate when compared to many other asset classes. As an example, according to data from S&P Dow Jones Global Indexes, as of May 31, 2016, dividend yields for four of the major asset classes are listed below:

o Preferred Stocks (as represented by the S&P 500 U.S. Preferred Stock index) – 6.16%

o Corporate Bonds (as represented by the S&P 500 Bond index) – 3.18%*

o Common Stocks (as represented by the S&P 500 index) –2.17%

o Treasury Bills (as represented by the S&P/BGCantor U.S. Treasury Bill index) – 0.26%*

*Yield to Maturity

• Dividends received from certain preferred stocks, as with many common stocks, may be eligible for the more preferential qualified dividend income (QDI) tax treatment.

• Preferred securities have a priority over common stocks in terms of dividend payments.

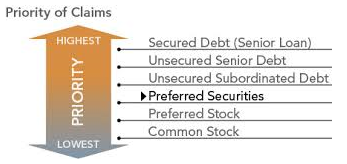

• Holders of preferred securities have a higher claim on company assets when compared to holders of common stock, though still below those of bondholders, in the event of a bankruptcy or liquidation.

Picture Source: www.Nuveen.com / About Nuveen Preferred Securities Funds.

• Preferred securities are generally listed on a stock exchange such as the NYSE and NASDAQ.

• Certain preferred securities have a defined maturity date.

• Preferred securities have a par value and many have a credit rating.

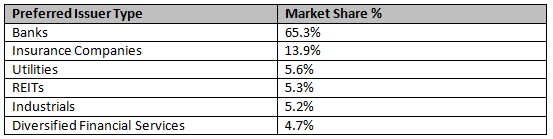

• Some of the most common issuers of preferred securities include banks, insurance companies, REITs and utilities.

Source: Nuveen Investments, Fixed Income Perspective: Preferred Securities, December 2015. Data from BofA Merill Lynch, Barclays as of 9/30/15 based on a blend of 65% BofA Merill Lynch U.S. Preferred Stock Fixed Rate Index/35% Barclays USD Capital Securities Index, which represents a blend of retail $25 par value securities and institutional $1,000 par value securities.

Some of the most commonly cited drawbacks of preferred securities include:

• Most preferred securities are callable at specified timeframes.

• The lack of a specific maturity date on many preferred securities makes recovery of invested principal uncertain.

• There is limited potential for price appreciation with preferred securities when compared to common stocks.

• Preferred securities have a degree of interest rate sensitivity and credit/issuer risk.

• There are no voting rights for holders of preferred securities as you would have for holders of common stocks.

Despite these drawbacks, preferred securities have attracted a lot of attention in recent years as fixed income yields overall have remained at historic lows as a result of the Federal Reserve’s efforts to revive the U.S. economy in the aftermath of the “great recession”. This has led many investors to consider adding exposure to preferred securities either through direct investments in the preferreds themselves or through packaged product structures such as closed-end funds, exchange-traded funds, open-end mutual funds and unit investment trusts. In terms of the breadth of the available preferred securities investment options, here is what we were able to find:

• Individual Preferred Securities – according to QuantumOnline as of June 21, 2016, there are 805 preferred stocks trading on the major stock exchanges plus most of the preferred stocks trading on the OTCBB, Pink Sheets and other OTC markets. This product coverage provided by QuantumOnline includes traditional preferred stocks, trust preferreds and traditional convertible preferreds. We will get into these product differentiators later in this whitepaper.

• Open-end Mutual Funds of Preferred Securities – according to Morningstar as of June 21, 2016, there are 56 share classes of mutual funds within the category of “Preferred Stock”.

• Closed-end Funds of Preferred Securities – According to Morningstar as of June 21, 2016, there are 15 closed-end funds within the category of “Preferred Stock”.

• Exchange-traded Funds of Preferred Securities – according to Morningstar as of June 21, 2016, there are 10 exchange-traded funds within the category of “US ETF Preferred Stock”.

• Unit Investment Trusts of Preferred Securities – unfortunately there is no current reliable source for this level of detail for UITs but Morningstar is working towards adding coverage of UITs in the not too distant future as we understand it.

Recognizing the potential value of preferred securities, along with the many different ways to access the product type, the question then becomes how to find the preferred securities with the highest probability of providing a high level of dependable income for the longest period of time with the lowest probability of potential loss of principal. Accordingly, when selecting preferred securities for applicable SmartTrust® UITs, the factors that typically serve as our primary screening criteria generally include, but are not limited to, the following:

• Issuer Name and Sector – issuer names help to determine how large of an issuer of preferred securities a given issuer is and the frequency at which they typically issue new series of preferred securities. To the extent possible, we try to limit over-concentrations to issuers within a given portfolio of preferred securities. We are also cognizant of the GICS sector of an issuer such that we can help limit over-concentration to any one GICS sector or GICS sub-industry within a given portfolio of preferred securities to the extent possible.

• Credit Rating – many preferred securities are rated by major credit rating agencies such as Standard & Poor’s (S&P) and Moody’s. We tend to prefer preferred securities that are rated by at least one of these major credit rating agencies.

• Coupon – similar to a bond, a preferred security has a stated coupon. We view this coupon relative to its credit rating and peer universe.

• Dividend Frequency – when building a portfolio of preferred securities, or other income-oriented securities for that matter, it is important to understand the frequency of dividend payments over the course of the year for each security (i.e. monthly, quarterly, semi-annually, annually) within the portfolio to determine the regularity of the payment cycle for the overall portfolio over the course of a year.

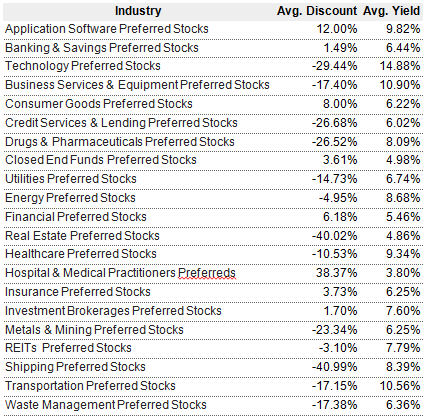

• Current Price – as the majority of preferred securities are issued at $25 a share, we tend to do further research on preferred issues that are trading well above or well below this par value. For example, the chart below provided by Preferred Stock Channel show the average discount or premium and average yield, as of July 7, 2016, by industry as defined by the Preferred Stock Channel. When reviewing this information, it is important to remember that past performance is not an indication of future results.

• Current Dividend Yield – this yield is simply a function of the coupon and the current price of a given preferred security. As with the coupon rate, we view current dividend yields relative to credit ratings and peer universes.

• Par Value – the par value of a preferred security helps to determine the current valuation of the preferred by viewing its current price relative to its par value. It is also an important consideration when reviewing preferred securities with defined maturity dates.

• Maturity Date – certain preferred securities have a defined maturity date while others are perpetual. Whereas a perpetual preferred stock will look to pay its fixed coupon for an indefinite period of time, a non-perpetual preferred stock has a specific maturity date associated with it where the issuing company will buy back shares at a specified price. These maturity dates are typically long-dated (i.e. 30 years or greater).

It should be pointed out that although a perpetual preferred stock does not have a stated maturity date, they often have call features that would allow the issuing company to buy back shares at a specified price, on specified dates, if they feel so inclined. Understanding when a preferred security can be called-in, or is scheduled to mature, is important to us when selecting preferreds for our portfolio strategies. As it relates to affected SmartTrust® UITs, we typically look to exclude preferred securities with next call dates or maturity dates within the life of a given series of a Trust strategy.

• Call Features – as stated previously, call features give the issuer the ability to buy back shares at a stated price at certain time intervals, whether there is a defined maturity date or not. When an issuer calls-in a preferred stock, it delivers cash, including any dividends due, to the former preferred stock shareholders. A reason why an issuer may want to call-in an outstanding series of preferred stock includes, but is not limited to, the current interest rate environment. For example, if interest rates are falling, or current interest rates are lower than the coupon rate of the preferred stock that was established at issuance, an issuer may deem that it is worthwhile to exercise their call rights on dates when such a call would be permissible.

From a valuation standpoint, this can work to the advantage or disadvantage of a preferred stock shareholder based on the current market price of the preferred stock versus its call price. From an income replacement standpoint, the former preferred stock shareholder will now have to find another investment vehicle to help replace the income generation capability that was lost when the preferred stock was called-in.

• Volume & Market Value Outstanding – volume and market value outstanding help to give a sense of the size, depth and liquidity of the preferred security under consideration. When reviewing volume information, we tend to prefer to consider the number of shares traded on average for the past thirty (30) trading days, though we will also consider longer and shorter timeframes to appreciate a wider sampling period and potential momentum characteristics.

• Cumulative Dividends vs. Non-Cumulative Dividends – dividend rights on a preferred security can include cumulative and non-cumulative. Before explaining the differences between these two features, it is important to remember that issuers of preferred stock can elect to defer or delay coupon payments. With this understanding, cumulative preferred stocks require the issuer to make up for any missed or deferred coupon payments whenever they do ultimately pay a given dividend. Non-Cumulative preferred stocks would not require the issuers to make their preferred stock shareholders “whole” under these circumstances. While most investors, including us at SmartTrust®, would prefer the cumulative dividends structure when selecting a preferred security for their portfolio, there are often not many to select from and those that are available may not meet the other screening criteria defined above.

• Convertibility – some preferred stocks are issued as convertible preferred stocks. This particular preferred stock type allows the holder of the preferred stock to convert the preferred shares into a fixed number of common shares on certain predefined dates. Typically, these conversions are exercised at the option of the shareholder but sometimes this option can be enacted by the issuer.

One SmartTrust® UIT strategy that invests primarily in preferred securities is the Preferreds Plus Trust. This trust seeks to provide investors with current income and the possibility of capital appreciation by investing in an unmanaged, diversified portfolio of preferred securities plus common stock of target-maturity exchange-traded funds (ETFs) with each ETF investing substantially all of its assets in foreign and domestic corporate bonds. Under normal market conditions, at least 80% of the trust’s net assets will be invested in preferred securities.

This Trust’s portfolio is divided into two asset segments as of the time of the original selection of the portfolio with at least 90% in preferred securities and up to 10% invested in the common stock of target-maturity ETFs. The preferred securities are selected largely utilizing the selection criteria outlined in this whitepaper and the ETFs are selected following a laddered, target-maturity, fixed income focus, with the allocation percentage to these ETFs at the time of their original selection determined based upon our outlook for preferred securities in general over the life of each series of the Trust.

While no screening criteria can guarantee the sustainability of dividend payments over time, we believe that the multi-factor approach employed at SmartTrust® can be helpful in providing portfolio strategies that strive to pay high, sustainable levels of income over the duration of each respective Trust series.

If you are interested in learning how we screen for high levels of sustainable distribution opportunities for other security types (i.e. closed-end funds, common stocks, etc…), please do not hesitate to contact our Internal Support Desk at 888-505-2872 or visit www.smarttrustuit.com.

——————————————————————————————————————————————

This paper is provided for informational purposes only. The discussion of specific stocks or UITs is not a solicitation to buy or sell any of the referenced securities. Investors should consider the Trust’s investment objective, risks, charges and expenses carefully before investing. The prospectus contains this and other information relevant to an investment in the Trust. Please advise your clients to read the prospectus carefully before they invest. If a prospectus did not accompany this literature, please contact SmartTrust® at (888) 505-2872 or visit www.smarttrustuit.com to obtain a free prospectus.